FINANCIAL FACTORS

As is with economic factors financial factors have an important bearing on the value of real estate. The financial system is also part of macro economics. The following are terms, rules and definitions which are considered to be most important when determining the value of real estate.

FINANCIAL MARKET TERMS:

See gross domestic product (gdp)

INVESTMENT SPENDING

Depends on the aggregate savings level and the "cost of money"; the interest rate. Government spending depends on the tax yield and the amount of government debt.

MONETARY POLICY

Monetary policy is achieved through interest rates that influence investment and consumer spending.

EXAMPLE

The government may raise taxes and/or interest rates when an economy is experiencing inflationary pressures as this will reduce total consumption and investment spending (demand driven inflation). On the other hand, when the economy is depressed, the government reduces taxes and/or interest rates by intervening in the money markets to stimulate consumption and investment spending.

Over time, this will raise the level of aggregate income and employment. Aggregate investment includes investment in real estate therefore, government policy which influences the money market and interest rates will in turn affect the real estate market.

Real estate is very sensitive to the condition of the money and capital markets because:

real estate transactions are commonly, large in relation to the assets of buyers and sellers.

real estate transactions are usually financed in part, by borrowed funds for example, by way of mortgage.

a great deal of real estate is bought for investment purposes. the potential investor compares not only the various real estate alternatives but other investments in the capital market (the opportunity cost of investment).

THE MONEY MARKET

The money market is the interaction of buyers and sellers trading in short term credit instruments such as short term notes. The short term is often defined as one year. The capital market is the interaction of buyers and sellers as they buy and sell long term financial instruments such as mortgages, bonds and stocks. The line between the two markets is often blurred as buyers and sellers move back and forth between the two.

MONEY MARKET TRANSACTIONS

Short term money markets affect the real estate market as they are used by developers to finance new construction and to provide bridging loans to finance the purchase of property while arrangements for more permanent finance is being completed. This is necessary because of the illiquid nature of the real estate investment. Short term rates are important because of the interrelationship between the two markets.

MONETARY POLICY AND INTEREST RATES

Interest rates are determined by supply and demand but are also subject to government monetary policies for example, inflationary or deflationary policies.

EFFECT ON REAL ESTATE

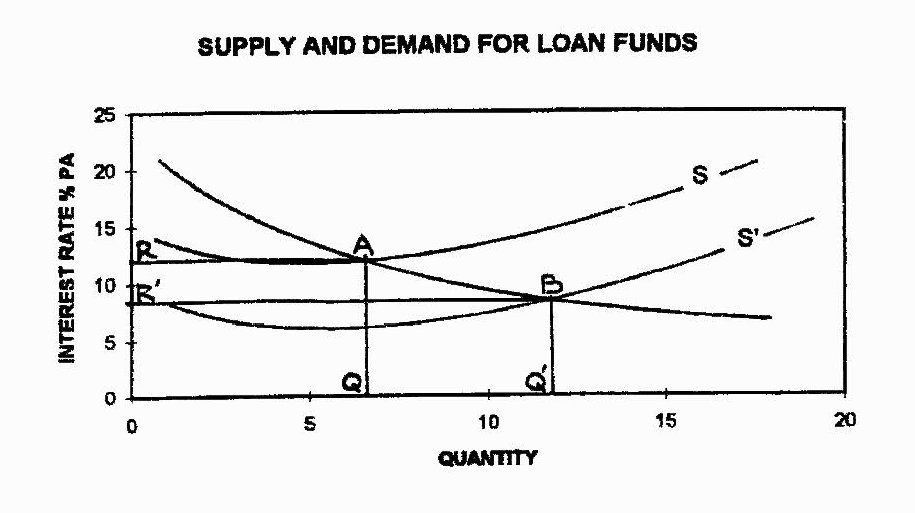

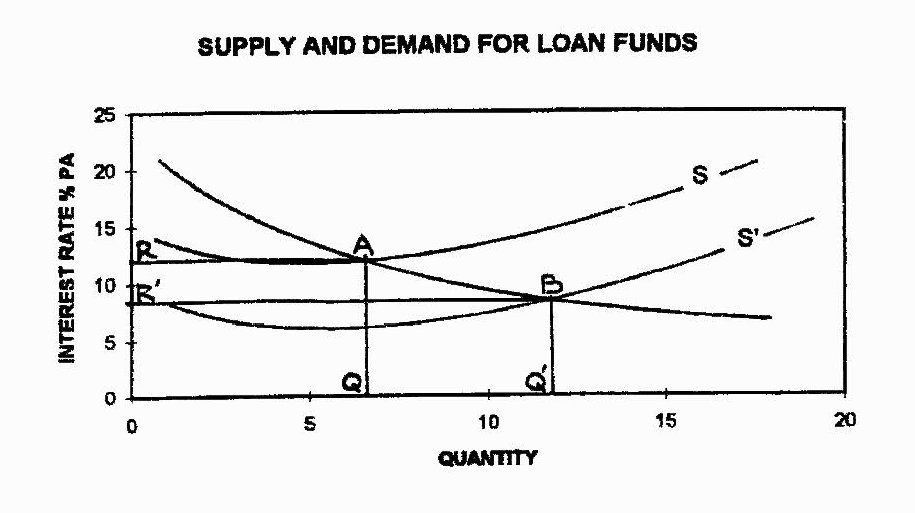

The availability of money and credit is a most important factor in real estate activity. As a general rule, low interest rates encourage strong activity and vice versa. Real estate is said to be procyclical that is, real estate activity increases with improved general economic conditions and vice versa. This is shown in the diagram below where a drop in interest rates from R to R' will result in an increase in the demand for loan funds from Q to Q'.

DIAGRAM

SUPPLY AND DEMAND FOR LOAN PURPOSES.

JOINT VENTURES

Joint ventures are the development of land jointly by a number of parties according to a joint venture agreement. If the venture is small and with a small number of people, the parties will form a partnership under the Partnership Act. On the other hand, if the venture is complex and/or consists of a large number of parties then a company is formed and used to develop the land. Joint ventures are often used to construct large projects with a financial institution supplying most of the capital (the "silent partner") while the other partners supplying materials and expertise. There is a trend for Governments to join with private developers in joint venture agreements.

Joint ventures are usually concerned with the development of the land and on completion, it is sold off and the partners share the proceeds of sale according to the terms of the venture agreement. Unlike syndicate members, joint venture partners are usually expert in the development process.

JOINT OWNERSHIP

Joint ownership is a "vehicle" used for the specific purpose of purchasing or developing property. Two or more parties for example, A and B form a company or partnership to purchase or develop land. The ownership vehicle is held in direct proportion to the level or interest A and B have in the company or partnership. Usually, the vehicle is created for one project only.

SUPERANNUATION FUNDS

Superannuation funds have traditionally invested in a range of investments (the investment portfolio) including real estate. The traditional breakup is between shares (equity), paper (bonds) and property. The proportion of each sector varies greatly between funds as it is determined by the fund's investment policy, risk profile and the need for liquid assets.