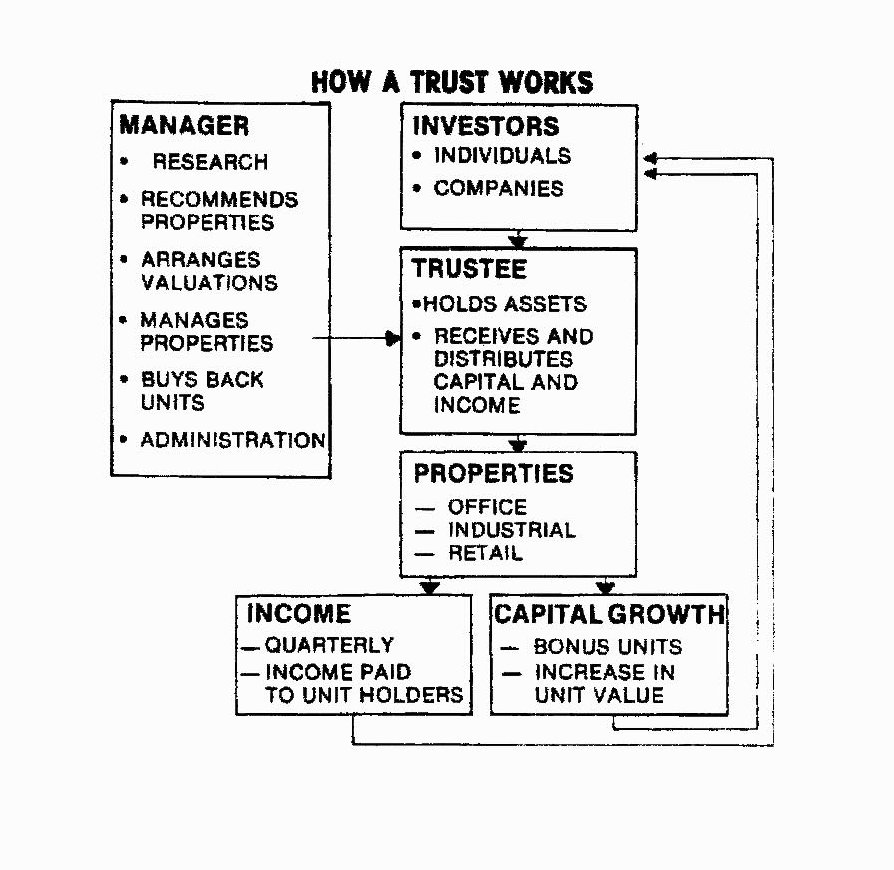

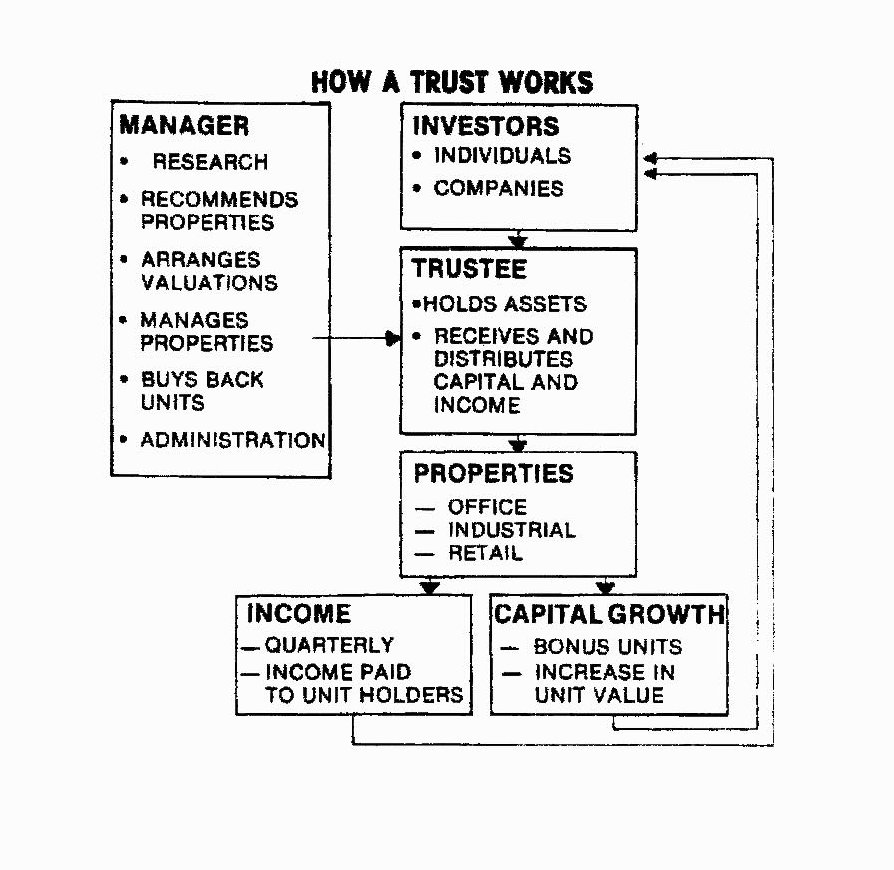

TRUST

A

trust deed is constructed in the standard form and if a company is

used, requires an NCSC approved prospectus before the units are

offered to the public. The subject property and related assets are

held in trust. The diagram below shows a typical trust structure.

Trusts

are often used to assemble equity funds for real estate investment.

Real estate investment trusts sell shares to small investors and use

the proceeds to acquire or develop real estate.

HOW

A TRUST WORKS

ADVANTAGES

- allows parties

to invest in property that would normally be out of their reach

- by pooling

resources two or more parties can purchase more expensive real estate

- when used to

purchase existing investment properties, will achieve earnings through

future rents and capital gains.

DISADVANTAGES

- potential risks

involved in investing a large amount in one property

- minor interest

holders may be outvoted by larger interests.