There are 3 methods of valuation for compensation purposes:

• piecemeal

• before and after

• reinstatement.

PIECEMEAL

Piecemeal is a summation method of valuation used to assess the special value to the owner. Each component of special value to the owner is separately determined. The following formula is used:

svo = mv + s + ia + c b

Where:

svo = special value to owner

mv = market value

s = severance damage

Ia = injurious affection

c = consequential loss

b = betterment.

This is the primary method when all or a small part of the affected land is taken.

PIECEMEAL EXAMPLE NON URBAN

A small part of a large rural property is resumed for road widening purposes:

-

Value of land taken:

$10 000

COSTS OF REPLACEMENT

Replacement of fences:

$3 000

Replacement of woolshed:

$12 000

Cost to move garage to

new access:

$3 000

Replacement of gardens:

$1 000

TOTAL COMPENSATION:

$29 000

PIECEMEAL EXAMPLE CORNER SPLAY

Resumption of a corner splay in a residential area:

|

Pro rata value of land taken: |

$1 500 |

|

Loss of trees and shrubs: |

$200 |

|

"Blot on title": |

$500 |

|

TOTAL COMPENSATION: |

$2 200 |

BEFORE AND AFTER

Before and after is the best method of valuation where a large part but not all of the land is taken. The method has the advantage of determining with one calculation, the following components of special value to the owner.

• market value of the land taken.

• any severance damage to the residue.

• any injurious affection to the residue.

• any betterment to the residue.

Therefore, the method has low error in determining the value of those parts. The only extra value required is for any consequential loss.

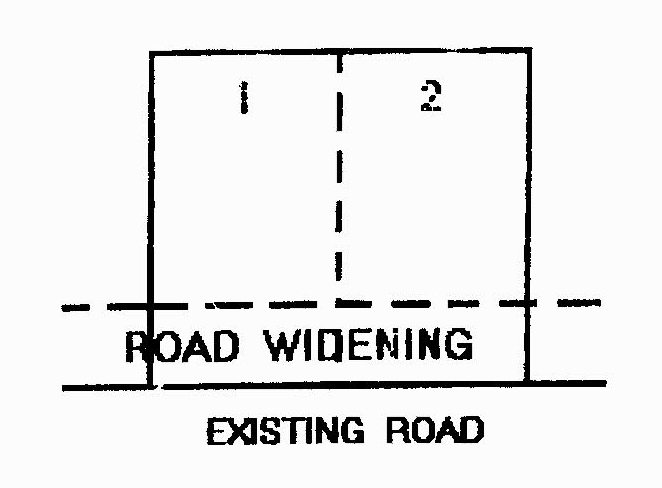

BEFORE AND AFTER EXAMPLE – ROAD WIDENING OVER SUBDIVIDED BLOCKS

REINSTATEMENT

Where there is sufficient evidence of market value, the amount of compensation can be determined using one of the above methods. However, there are a number of land uses that do not have a market For example:

• hospitals

• churches

• schools

• civic centres.

When these properties are resumed reinstatement is used:

In some special cases, eg hospitals, schools and churches, for which there is ordinarily no market, the cost of reinstatement may be adopted as the measure of value though probably the property taken would not bring in the market any sum approaching the cost of reinstatement" (Min for Stage for the Army v Parbury Henty 8e Co (1945) 70 CLR 459, 491).

The reinstatement method is subject to the problem of "new for old" that is, the dispossessed owner will be better off after the compulsory taking of his/her land than before. Therefore, the courts have established strict criteria before compensation is awarded using reinstatement. Both the ALRC and the Morris Report attempted to account for the "new for old" problem by discounting the compensation otherwise payable by depreciation.

However, the Nevill Report (WA) and current law rejects such an approach as being too unwieldy, particularly where the claimant cannot locate to "equivalent" premises. The necessary criteria before reinstatement can be used in compensation valuations are:

• THE USE MUST HAVE NO GENERAL MARKET

However, with the ability of old inner city churches to be converted into restaurants, homes and even nightclubs, it is doubtful whether or not there are buildings that meet this criterion.

• BUT FOR THE RESUMPTION, THE LAND WOULD HAVE CONTINUED TO HAVE BEEN USED FOR THAT PURPOSE

This is an important criterion as sometimes the non market use is not supported or required in the neighbourhood.

EXAMPLE

A church must have a reasonable following or a sizeable congregation.

• THE CLAIMANT MUST HAVE A "BONA FIDE" INTENTION TO REINSTATE IN ANOTHER PLACE

This means that if the building were lost, the church or organization would genuinely search for another site and rebuild (Comm of Highways v George Eblen PL (1975) 10 SASR 384). This would also be subject to a positive judgment in point 2.

Reinstatement was not allowed for:

• a laundry in Re Fish Steam Laundry PL (1945) QSR 96

• a racing club in Min for State v Brisbane Amateur Turf Club (1949) 80 CLR 123.

However, the method has been allowed for some businesses for example in Cook v Comm of Rail (1945) 19 LGR (NSW) 226. The reinstatement method is part of South Australian law (s25(i) Land Acquisition Act 1969), United Kingdom law (rule 5, section 5 Land Compensation Act 1961) and Canadian law (s24(4) Expropriation Act 1970).

THE PROBLEM OF DOUBLE ACCOUNTING

The valuer should be careful to avoid "double accounting" when the reinstatement or replacement method of valuation is used. If the dispossessed owner has received monies to reinstate a building partly taken, he/she cannot receive further compensation for the value of that part taken. This problem was addressed in G & R Wills v The Corporation of Ade/aide (1962) 108 CLR 1 as follows:

He should however, have also taken into account, as part of the plaintiffs loss, the diminution of floor space caused by the resumption, and that unless replaced this loss of space would necessarily interfere with the conduct by it of its business. To take the cost of replacing on the land retained the floor space lost by the resumption seems to us, in all the circumstances, to provide a reasonable method whereby to measure the compensation payable for that loss, but in doing so the value placed on the portion of the building on the land resumed must be deducted, otherwise the plaintiff, at the defendant's expense, would be able to provide upon the land retained the same accommodation as it had before the resumption and in addition have the $70 000 representing the value of the portion of the building which stood upon the land resumed.

There have also been double accounting when the capitalization method of valuation is used to value the affected premises. For example, the net rents of a butcher's shop may be capitalized so as to find the value of that shop. However, since the net rent is for both the building AND land, it would be double accounting to then pay the affected owner compensation for the land as well.

INTEREST SHOULD BE PAID ON COMPENSATION VALUE

Once the land is resumed, title vests in the resuming agency or Crown and all former interests are converted into claims for compensation. The dispossessed owner should be entitled to interest on any monies owing by the acquiring authority from the date of resumption to the date of payment. Most states allow for the payment of interest on outstanding amounts at the relevant Commonwealth Trading Bank overdraft rate.