STATISTICAL

INFERENCE

In this part we will use the Summerton sales as a basis

for predicting property values in that suburb.

See analyzing and

presenting data

The use of predicted

sale prices is not so much a valuation method (as this is not

acceptable to the courts or industry) but as a description of possible

trends in this locality. That is, as with the previous part sales data

can be analyzed and used to predict general values in foe example, an

"investment report".

CONFIDENCE INTERVALS

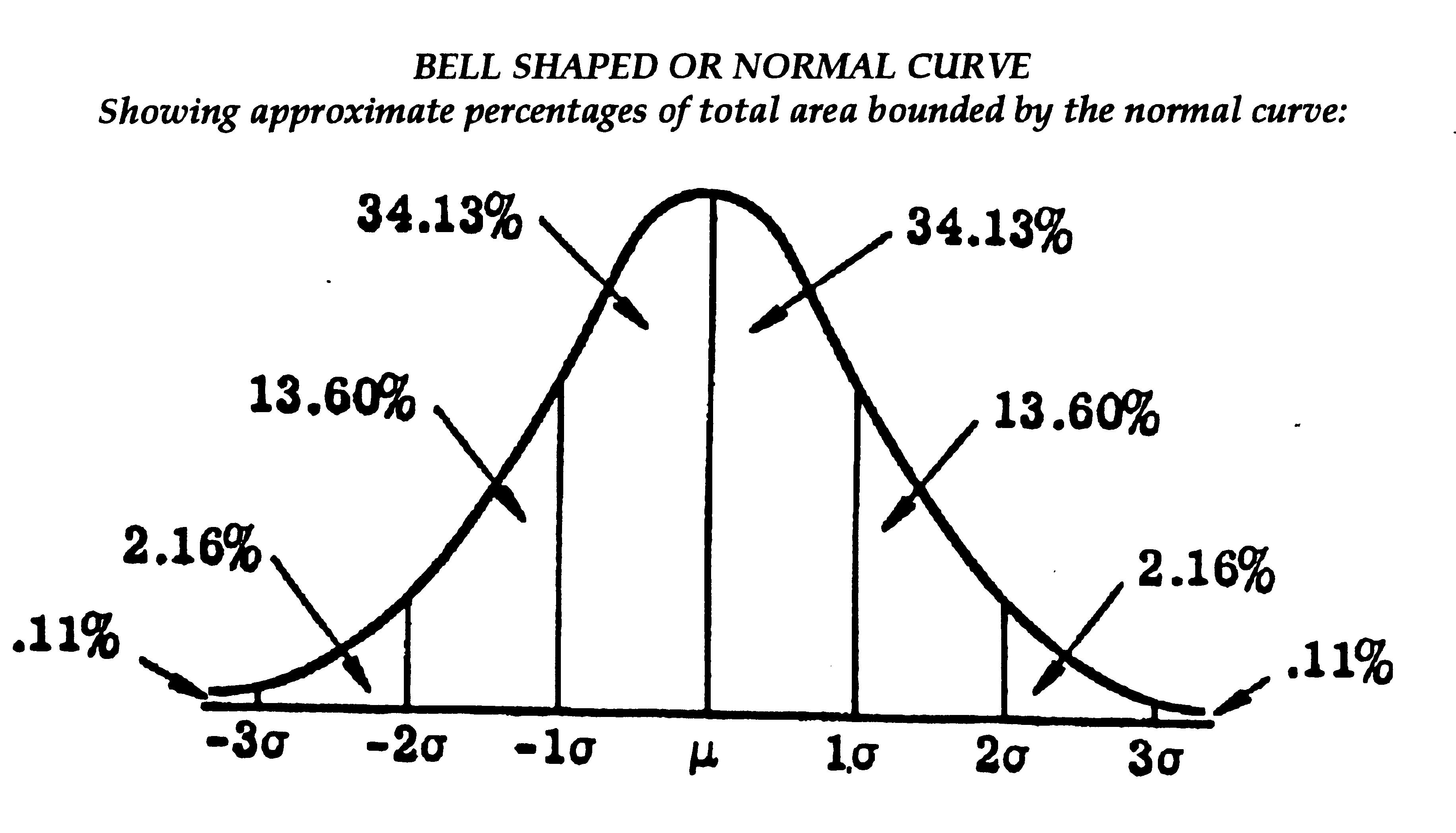

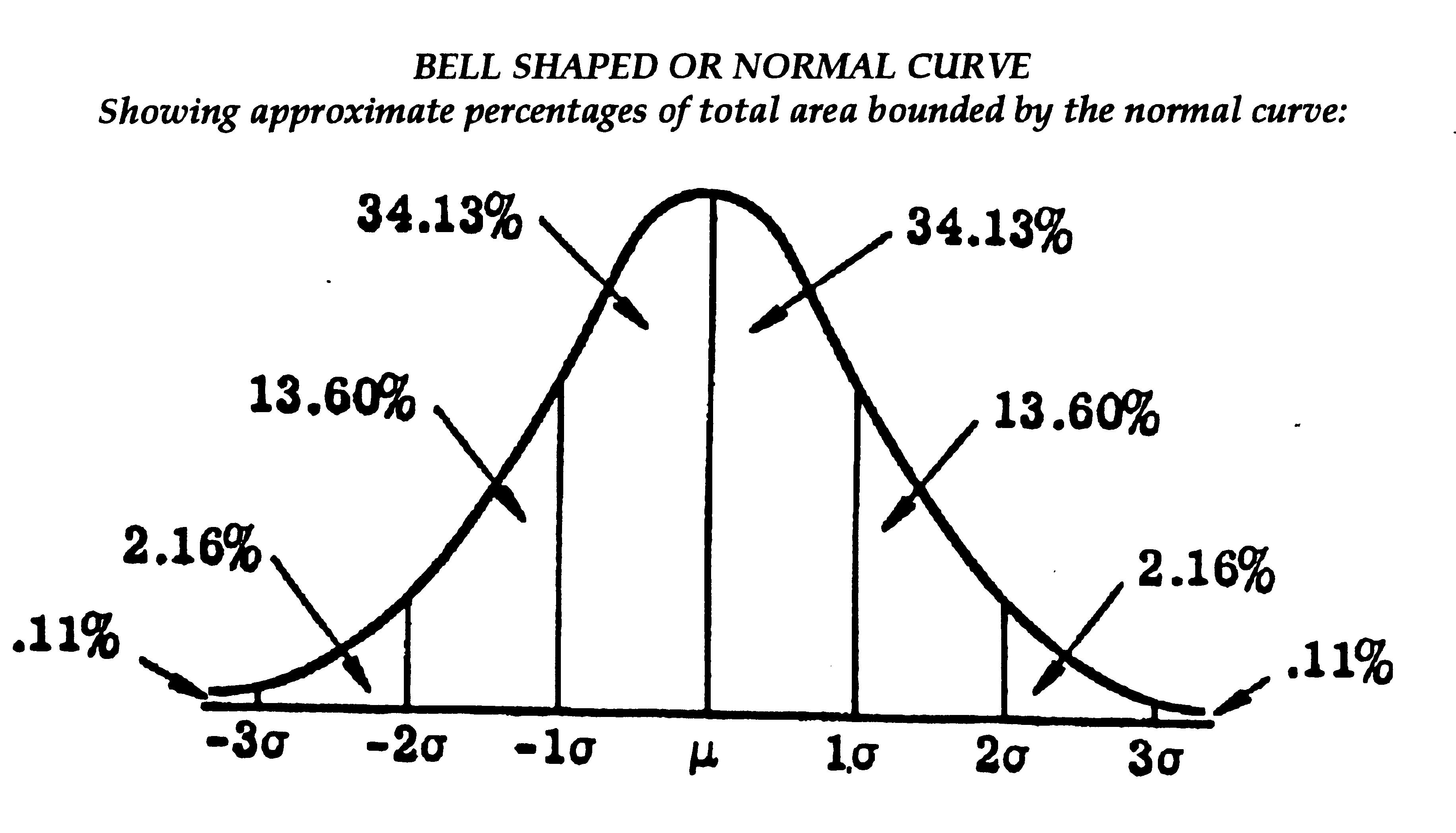

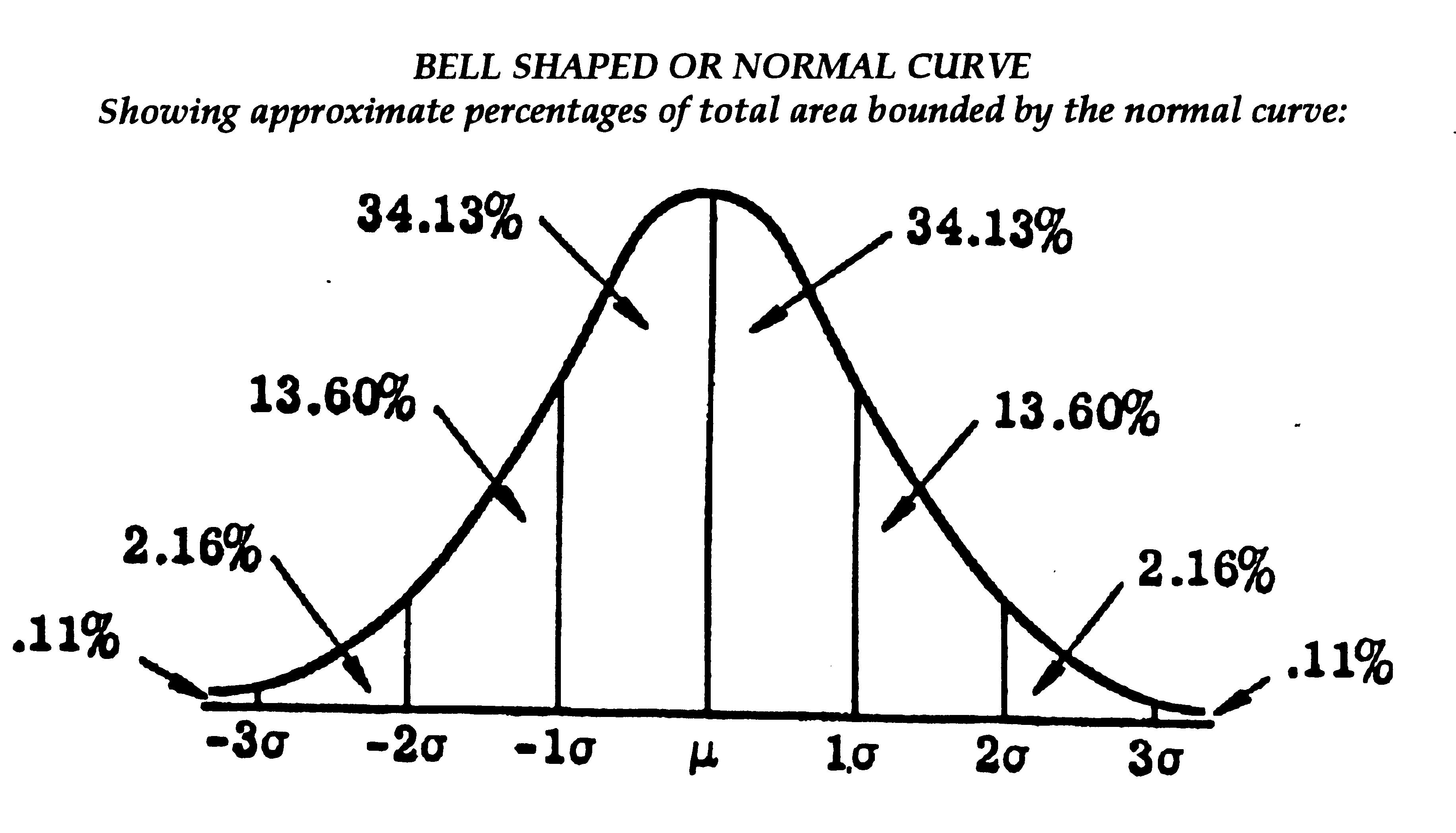

The standard

deviation can be used to indicate what percentage of the sample of a

population may be expected to fall within selected confidence

intervals. As the diagram below shows about 68.26% of the sample of the

population will generally fall within plus or minus one standard

deviation from the mean assuming that the data approximates a normal

distribution.

Normally at least 30 random sales are required to confidently state

that the sample is representative of the population. For Summerton we

only have 19 sales which are skewed, but for the purposes of this part

we will assume that the sample approximates a normal curve and is

representative of the population (Summerton houses).

Assuming the sales

data in Summerton approximates a normal distribution 68.26% of the

sales will fall between the mean - 1 standard deviation and the mean +

1 standard deviation, about 95.44% should fall with 2 standard

deviations either side of the mean and about 99.74% should fall within

3 standard deviations either side of the mean - see diagram above.

STATISTICAL INFERENCE

Past sale prices and rents can be used to predict future prices, rents,

and values.

EXAMPLE

What percentage of sales fall within the range of 10 (000) on either

side of the mean (598.4) for the Summerton sales?

Using the Z score formula:

Z = R/STD = 10/325.5 = 0.0307

Where:

R = required range (10)

STD = standard deviation

The Z score shows that 608.4 and 588.4 each deviate from the mean by

0.0307 standard deviations. The percent is found by referring to the

diagram below which shows a value of about 0.012. Therefore, about 1.2%

of sales lie between the mean and 608.4 and about 2.4% lie between

608.4 and 588.4.

PROBABILITY

USING Z VALUES

The probability of a

selected sale falling between a given range can be found with the above

formula. For a range of +5(000) and -5(000) of either side of the mean:

Z = 5/325.5 = 0.0154

See Z values – table

The Z value table shows that a Z value of 0.0154 corresponds to about

.006 (by interpolation) Therefore, there is about a 0.6% chance that

the sale will fall within the range 5(000) above the mean or 1.2%

chance that it will fall between 330.5 and 320.5.

CONFIDENCE LEVELS

For a number of

statistical analyses a 95% confidence level is required. From the

previous calculations we can state with 95% degree of confidence a sale

will fall between 1.96 standard deviations either side of the mean -

see diagram above and Z value table.

That is 1.96 * 325.5

= 638 either side of the mean however, such statements depend on how

accurately the estimated mean represents the population mean.

Regardless of the size of the population there is a specific sample

size that will permit a certain level of confidence in the estimated

mean.

NECESSARY SAMPLE SIZE

The necessary sample

size can be calculated with the following formula:

n = (Z2*STD2)/e2

Where:

n = the sample size required

z = z value at the required degree of confidence eg 95%

STD = standard deviation

e = range from the

mean.

EXAMPLE

Determine the sample size required from Summerton for the valuer to be

95% confident that the true mean is within +/-10(000) of the estimated

mean of 600(000). That is, between 588.4 and 608.4(000):

n = (1.962*325.52)/102 = (3.842 * 105950)/100 = 407061/100 = 4071

Therefore, the

Summerton sample is well short of the required number of sales for the

valuer to be 95% confident that they will represent the population.

Note that this confidence limit is at variance with standard valuation

practice where commonly, a few comparable sales meeting the rigorous

standards of the willing buyer-willing seller theory will

provide extremely reliable evidence of market value.

SCATTERPLOTS

Scatterplots are

useful devices for determining relationships between variables. In

valuation work there are a number of variables which affect the value

of real estate which can be shown to correlate with market value.

EXAMPLE

The 19 sales in

Summerton are plotted against distance from the local railway station.

The following scatterplot results:

SALE PRICE VERSUS

DISTANCE FROM RAILWAY STATION

A visual inspection

of the scatterplot above shows a reasonable inverse correlation between

sale prices and distance from the local railway station. On the other

hand the scatterplot below shows no discernable pattern and there would

appear to be no correlation between sale price and distance from

railway station:

OUTLIERS

There are 2 or 3

outliers shown on the scatterplot. Outliers are most important and will

show either an error in the sample or application or may indicate an

interesting new variable which should be examined. Valid outliers

require further investigation.

Upon investigation it

is found that the reason why prices of the outliers had held up so well

despite the distance from the local railway station is because they

come inside the commuting area of the neighbouring railway station.

Therefore, the plot would support the hypothesis.

TIME SERIES

Values and rents can

be traced over time to ascertain a trend and for prediction. Although

cyclical theory has been discredited for land values the "boom bust"

pattern can be discerned over time.

STATISTICAL

INFERENCE

In this part we will use the Summerton sales as a basis

for predicting property values in that suburb.

See analyzing and

presenting data

The use of predicted

sale prices is not so much a valuation method (as this is not

acceptable to the courts or industry) but as a description of possible

trends in this locality. That is, as with the previous part sales data

can be analyzed and used to predict general values in foe example, an

"investment report".

CONFIDENCE INTERVALS

The standard

deviation can be used to indicate what percentage of the sample of a

population may be expected to fall within selected confidence

intervals. As the diagram below shows about 68.26% of the sample of the

population will generally fall within plus or minus one standard

deviation from the mean assuming that the data approximates a normal

distribution.

Normally at least 30 random sales are required to confidently state

that the sample is representative of the population. For Summerton we

only have 19 sales which are skewed, but for the purposes of this part

we will assume that the sample approximates a normal curve and is

representative of the population (Summerton houses).

Assuming the sales

data in Summerton approximates a normal distribution 68.26% of the

sales will fall between the mean - 1 standard deviation and the mean +

1 standard deviation, about 95.44% should fall with 2 standard

deviations either side of the mean and about 99.74% should fall within

3 standard deviations either side of the mean - see diagram above.

STATISTICAL INFERENCE

Past sale prices and rents can be used to predict future prices, rents,

and values.

EXAMPLE

What percentage of sales fall within the range of 10 (000) on either

side of the mean (598.4) for the Summerton sales?

Using the Z score formula:

Z = R/STD = 10/325.5 = 0.0307

Where:

R = required range (10)

STD = standard deviation

The Z score shows that 608.4 and 588.4 each deviate from the mean by

0.0307 standard deviations. The percent is found by referring to the

diagram below which shows a value of about 0.012. Therefore, about 1.2%

of sales lie between the mean and 608.4 and about 2.4% lie between

608.4 and 588.4.

PROBABILITY

USING Z VALUES

The probability of a

selected sale falling between a given range can be found with the above

formula. For a range of +5(000) and -5(000) of either side of the mean:

Z = 5/325.5 = 0.0154

See Z values – table

The Z value table shows that a Z value of 0.0154 corresponds to about

.006 (by interpolation) Therefore, there is about a 0.6% chance that

the sale will fall within the range 5(000) above the mean or 1.2%

chance that it will fall between 330.5 and 320.5.

CONFIDENCE LEVELS

For a number of

statistical analyses a 95% confidence level is required. From the

previous calculations we can state with 95% degree of confidence a sale

will fall between 1.96 standard deviations either side of the mean -

see diagram above and Z value table.

That is 1.96 * 325.5

= 638 either side of the mean however, such statements depend on how

accurately the estimated mean represents the population mean.

Regardless of the size of the population there is a specific sample

size that will permit a certain level of confidence in the estimated

mean.

NECESSARY SAMPLE SIZE

The necessary sample

size can be calculated with the following formula:

n = (Z2*STD2)/e2

Where:

n = the sample size required

z = z value at the required degree of confidence eg 95%

STD = standard deviation

e = range from the

mean.

EXAMPLE

Determine the sample size required from Summerton for the valuer to be

95% confident that the true mean is within +/-10(000) of the estimated

mean of 600(000). That is, between 588.4 and 608.4(000):

n = (1.962*325.52)/102 = (3.842 * 105950)/100 = 407061/100 = 4071

Therefore, the

Summerton sample is well short of the required number of sales for the

valuer to be 95% confident that they will represent the population.

Note that this confidence limit is at variance with standard valuation

practice where commonly, a few comparable sales meeting the rigorous

standards of the willing buyer-willing seller theory will

provide extremely reliable evidence of market value.

SCATTERPLOTS

Scatterplots are

useful devices for determining relationships between variables. In

valuation work there are a number of variables which affect the value

of real estate which can be shown to correlate with market value.

EXAMPLE

The 19 sales in

Summerton are plotted against distance from the local railway station.

The following scatterplot results:

SALE PRICE VERSUS

DISTANCE FROM RAILWAY STATION

A visual inspection

of the scatterplot above shows a reasonable inverse correlation between

sale prices and distance from the local railway station. On the other

hand the scatterplot below shows no discernable pattern and there would

appear to be no correlation between sale price and distance from

railway station:

OUTLIERS

There are 2 or 3

outliers shown on the scatterplot. Outliers are most important and will

show either an error in the sample or application or may indicate an

interesting new variable which should be examined. Valid outliers

require further investigation.

Upon investigation it

is found that the reason why prices of the outliers had held up so well

despite the distance from the local railway station is because they

come inside the commuting area of the neighbouring railway station.

Therefore, the plot would support the hypothesis.

TIME SERIES

Values and rents can

be traced over time to ascertain a trend and for prediction. Although

cyclical theory has been discredited for land values the "boom bust"

pattern can be discerned over time.

The above time series

show office rents for a particular type of office block in Sydney over

a period of 5 years. The series can be made into a "control chart" by

including "upper" and "lower" control limits which are usually 2

standard deviations. These are shown on the Z value table and those

values outside the control limits are treated as outliers.

Often such plots need

smoothing to ascertain some underlining trend. This can be done

for example by using a running medium of 3 which means each

data point is the mean of that point plus its two neighbouring points.

"t" DISTRIBUTION

As sample sizes decrease the sampling distribution of their means

becomes more pointed in the middle and has relatively more area in

their tails. Such a distribution is known as the "t" distribution or

"students" distribution. The diagram below compares the normal curve A

with two "t" distributions, B and C:

THE "t" DISTRIBUTION VERSUS THE NORMAL CURVE

7

The above time series

show office rents for a particular type of office block in Sydney over

a period of 5 years. The series can be made into a "control chart" by

including "upper" and "lower" control limits which are usually 2

standard deviations. These are shown on the Z value table and those

values outside the control limits are treated as outliers.

Often such plots need

smoothing to ascertain some underlining trend. This can be done

for example by using a running medium of 3 which means each

data point is the mean of that point plus its two neighbouring points.

"t" DISTRIBUTION

As sample sizes decrease the sampling distribution of their means

becomes more pointed in the middle and has relatively more area in

their tails. Such a distribution is known as the "t" distribution or

"students" distribution. The diagram below compares the normal curve A

with two "t" distributions, B and C:

THE "t" DISTRIBUTION VERSUS THE NORMAL CURVE

7