INTEREST

RATES - RURAL

Interest

rates are also an important determinant of farm financial

performance. A large proportion of farms carry high levels of debt

and many were affected by the large rise in interest rates in the

late 1980s and the large falls in the rates since 1989.

Interest

rates change will affect farm incomes directly. By changing the size

of interest repayments and indirectly through any changes induced in

the exchange rate. Interest payments make up about 11% on average of

total farm cash costs. However, there is a large variation in debt

between farms. For example, 25% of all broadacre farms had debts of

more than $141 000 in 1991-92 and 12.5% carried debts of more than

$271 000. On the other hand more than 25% carried no debt in 1991-92.

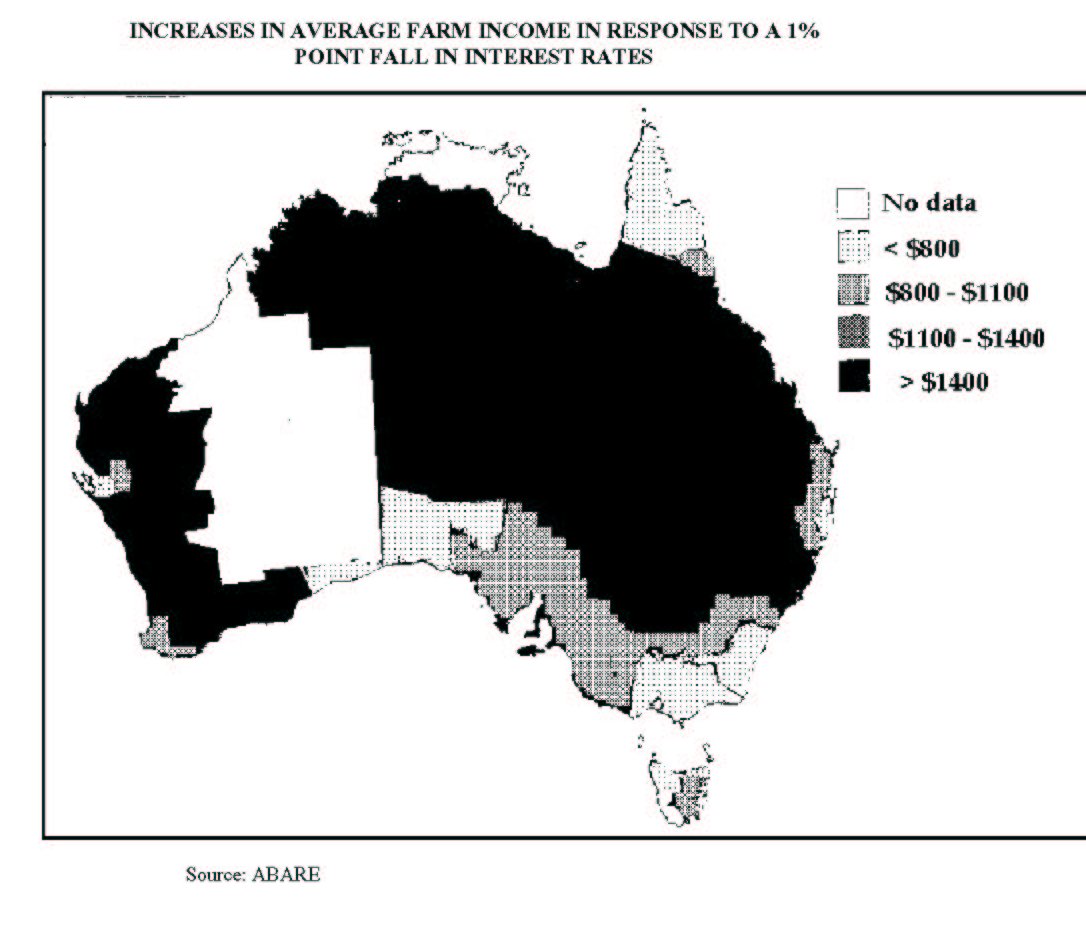

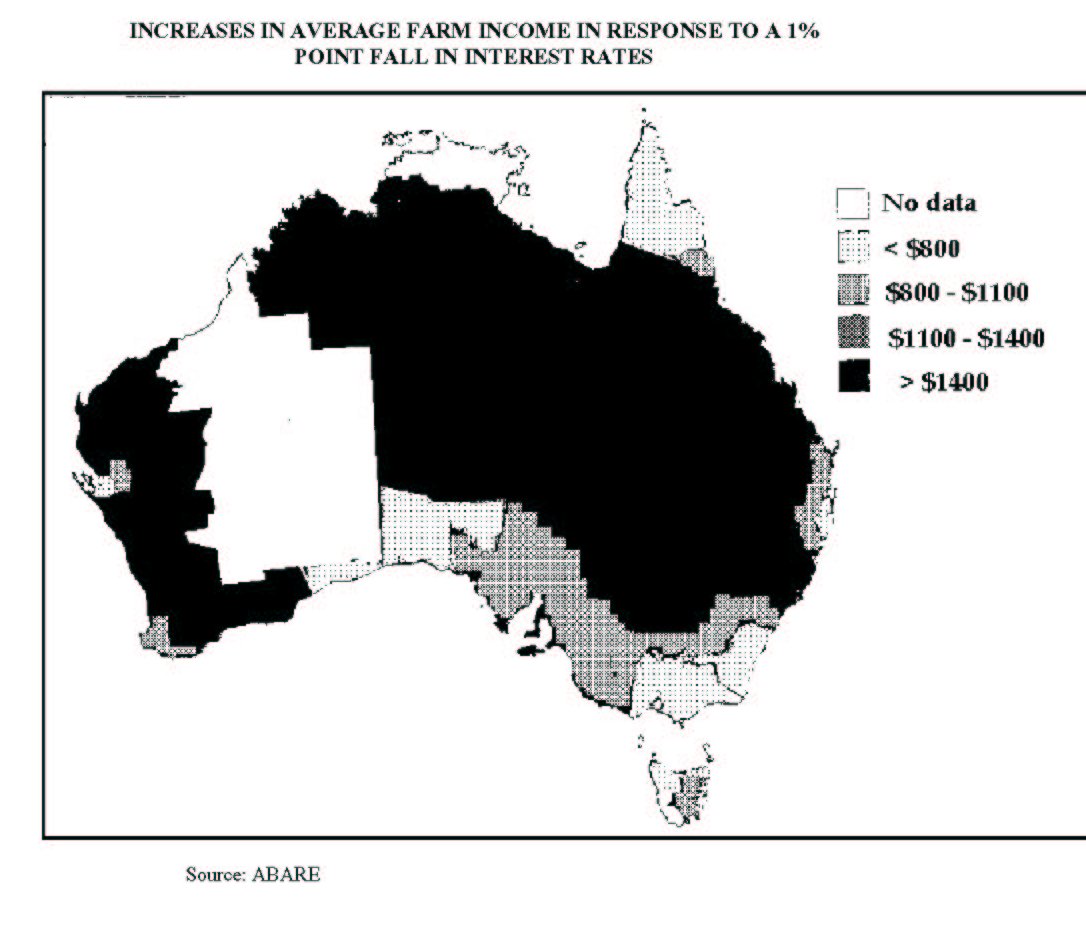

In

the study it was found that the farm incomes in the intensive

cropping regions and the northern beef pastoral regions are the most

affected and the incomes of sheep pastoralists and those farmers in

the high rainfall areas are the lest affected.

Other

areas where incomes are greatly affected by interest rate changes

include the high rainfall areas in the south eastern corner of SA and

in western Victoria. In general, farm incomes in the high rainfall

areas of south eastern Australia are less affected by interest rates.

the

two maps below show the areas most affected by a 1% fall in interest

rates:

2