GENERAL

SYSTEM THEORY (GST) AND VALUATION

david hornby MEA Llb FAPI

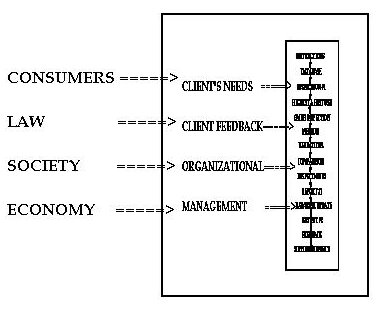

Traditional scientific theory has been modified and enriched by

knowledge from a variety of underlying disciplines. General Systems

Theory (GST) offers the opportunity of synthesis in scientific research

and theory and allows us to view the total subject of study. For

example, a valuation system including its interaction with its many

environments and recognition of the relevant subsystems.

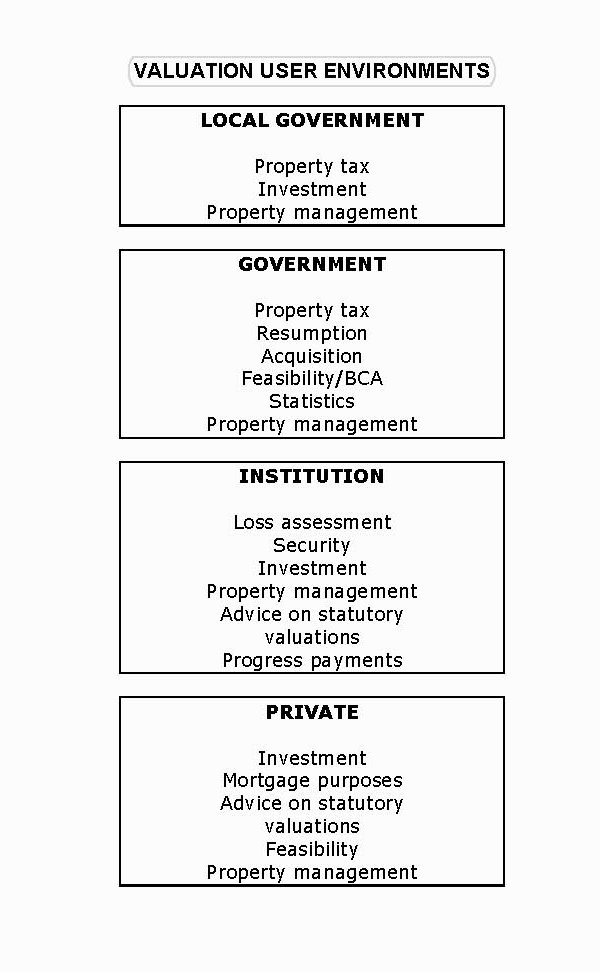

A SYSTEM is

an organised unitary whole but composed of two or more interdependent

parts or subsystems with identifiable boundaries from its environmental

suprasystem. Therefore, what is generally thought of as the valuation

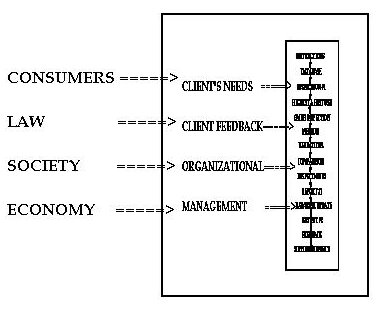

process, is in reality only a subsystem. This is shown in the diagram

below shows the environments for a valuation. GST goes further,

providing a basic frame of reference for the development of a total

valuation system and therefore, helps the valuer to understand the "big

picture". GST and its basic

concepts were pioneered by the biologist, Ludwig von Bertalanffy

(1950).

The biology analogy is most useful for the complex economic, financial,

social, mercantile and legal system which is valuation. The valuation

process can be compared with an organism as it is a system of mutually

dependent parts, each of which includes many subsystems. The starting

point of GST is the important distinction between closed and open

systems.

CLOSED SYSTEMS

A number of physical and mechanical systems can be considered as

"closed" in relationship to their environment. That is, there is very

little intercourse between the system and it's outside environment. A

closed system is inefficient and will eventually "die". For example, a

shopping centre that ignores changing demographic factors within it's

trade area or what it's competitors are doing.

OPEN SYSTEMS

Unlike a closed

system, the valuation process is in constant interaction with its

environment and is therefore, an open system. Too many commentators in

valuation fail to recognise this. For example, what may appear to be a

brilliant valuation method in the cloistered atmosphere of academia may

prove to be completely useless in the "real" world of valuation. The

concept of open or closed is a matter of degree and in an absolute

sense, all systems are open or closed, depending on the point of

reference. All systems are "closed" to some degree from external forces

for example, the valuer generally does not reveal ALL his workings in

the valuation report. GST allows better

understanding and integration of knowledge from a wide range of

specialized fields or disciplines. In the valuation process these

include:

- economics

- social (values)

- legal

- financial

- science and

technology.

The social nature of

the valuation process should not be underestimated for example, writers

such as Talcott Parsons have used the systems approach to effectively

analyze and understand society. Parson's method can also be used to

analyze and understand buyers and sellers in real estate market

transactions (1951).

Economists have also

used the systems approach for example, with equilibrium concepts which

are fundamental in economic thought, and the very basis of this type of

analysis is the consideration of subsystems of a total system.

Economics is moving away from static equilibrium models appropriate to

closed systems toward dynamic equilibrium considerations appropriate to

open systems.

HOLISM

Holism is the view that all systems are composed of interrelated

subsystems. The whole is not just the sum of the parts, but the system

itself can only be explained as a totality. This concept applies to the

valuation process. For example, the "identification of land" system

(the starting point for the valuation process) consists of surveying,

land titles, plans, maps, curtilages, fencelines subsystems.

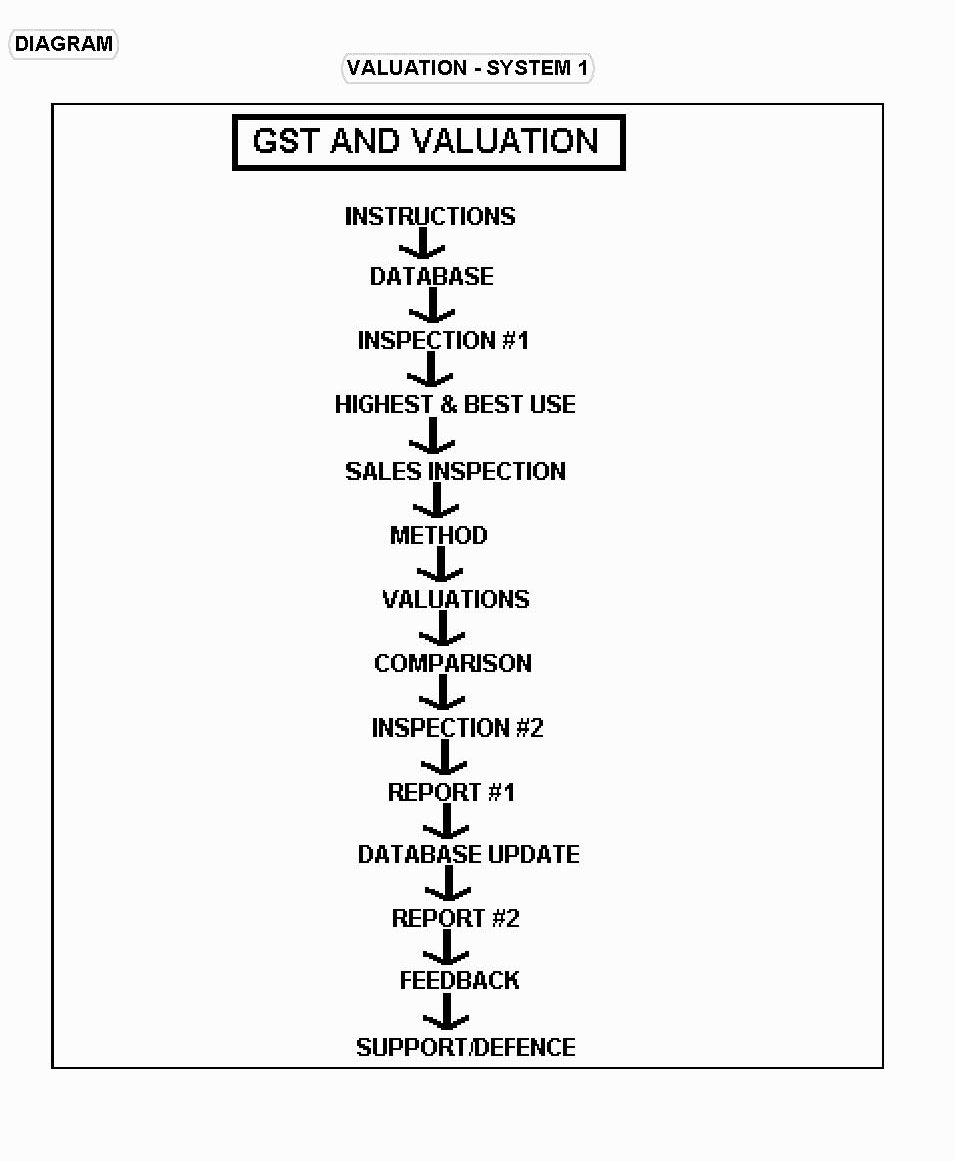

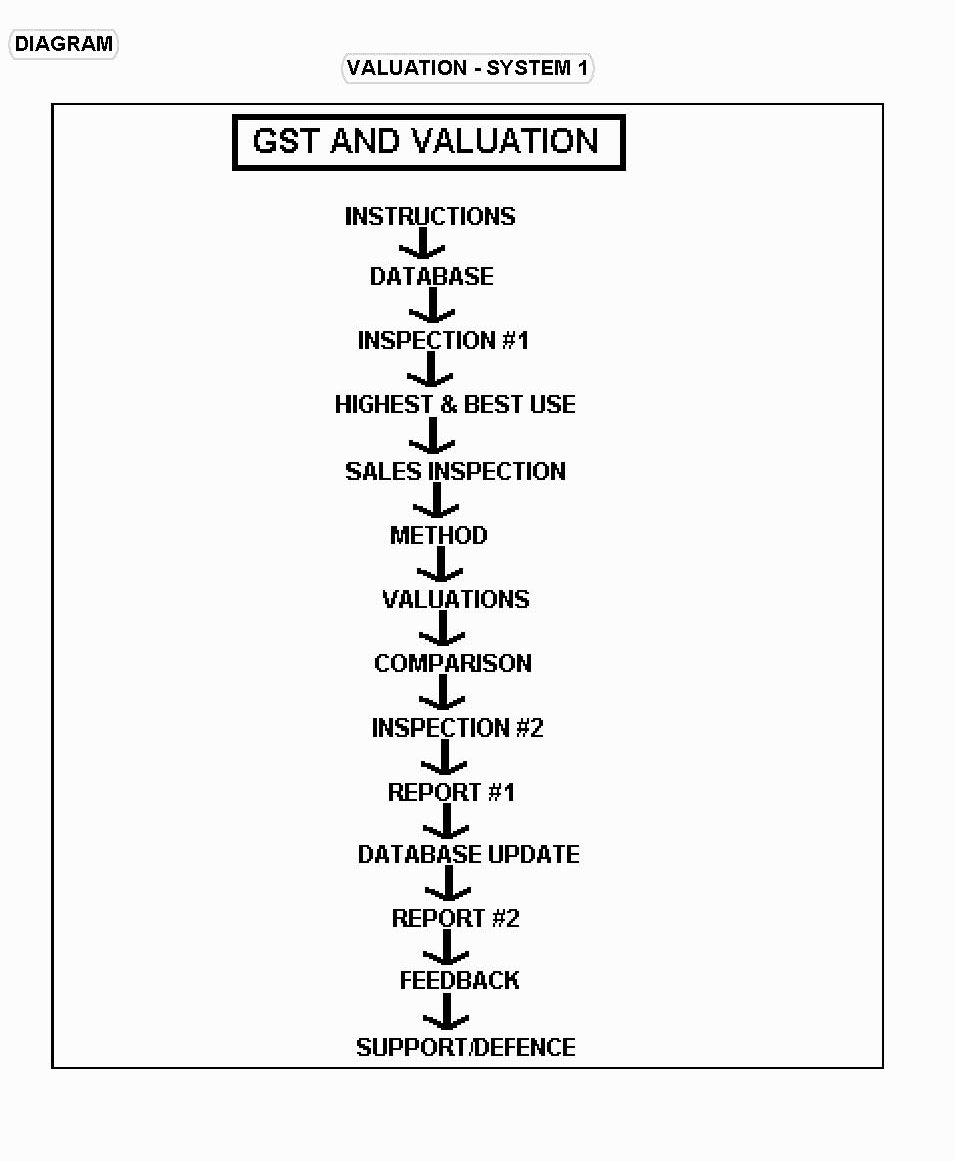

KEY CONCEPTS OF GST AND VALUATION

BOUNDARIES

The closed system has rigid, impenetrable boundaries whereas the open

system has permeable boundaries between itself and the outside

environment. Boundaries set the "domain" of the organization's

activities. The valuation process has been largely thought of as a

closed system similar to that in diagram one. That is, valuation has

been largely seen from the perspective of the valuer, "downplaying" the

effect of the other environments and systems in the process. However

this is not the case. Rather, valuation is a mix of largely, economics,

law, politics and values. The boundaries are not easily defined and are

determined primarily by the functions and uses of the valuation. The valuation system

should be seen within the context of broader perspectives including the

needs of clients and organizational factors.

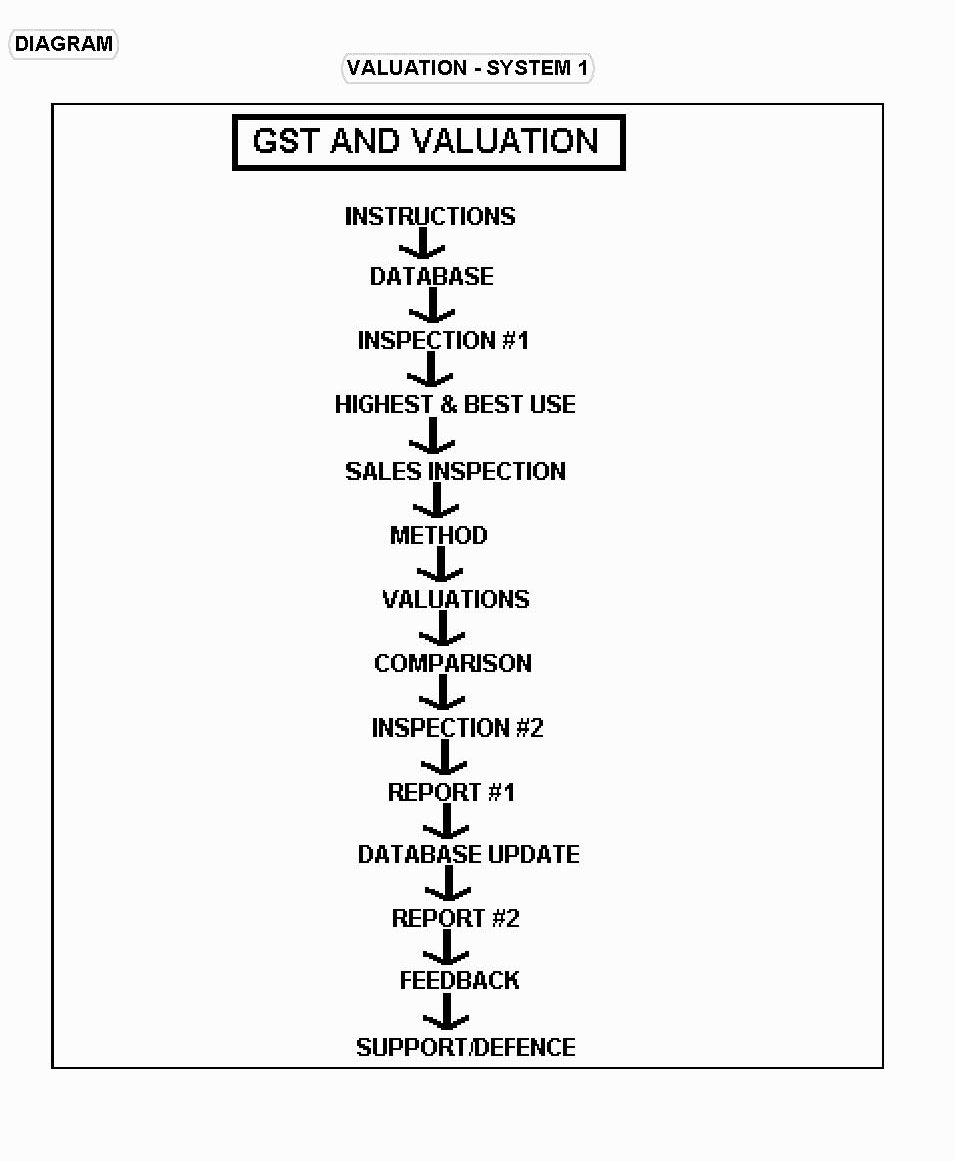

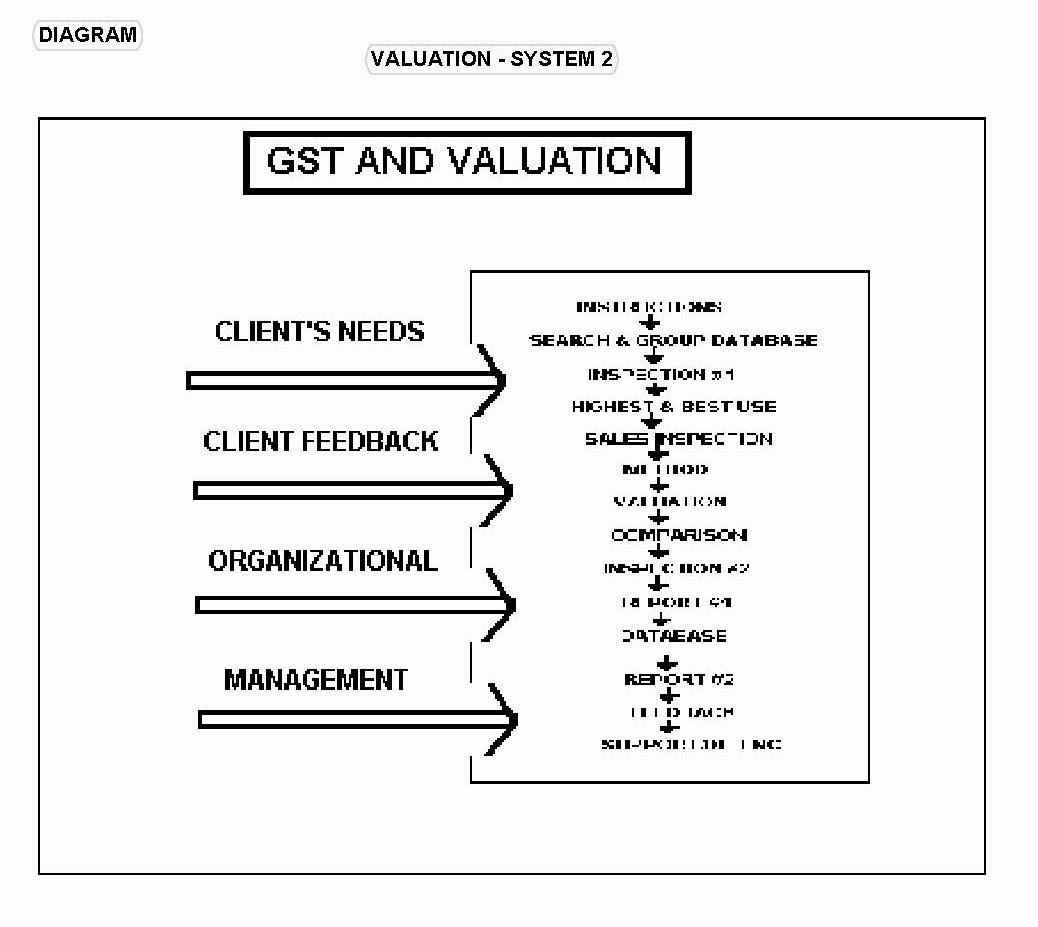

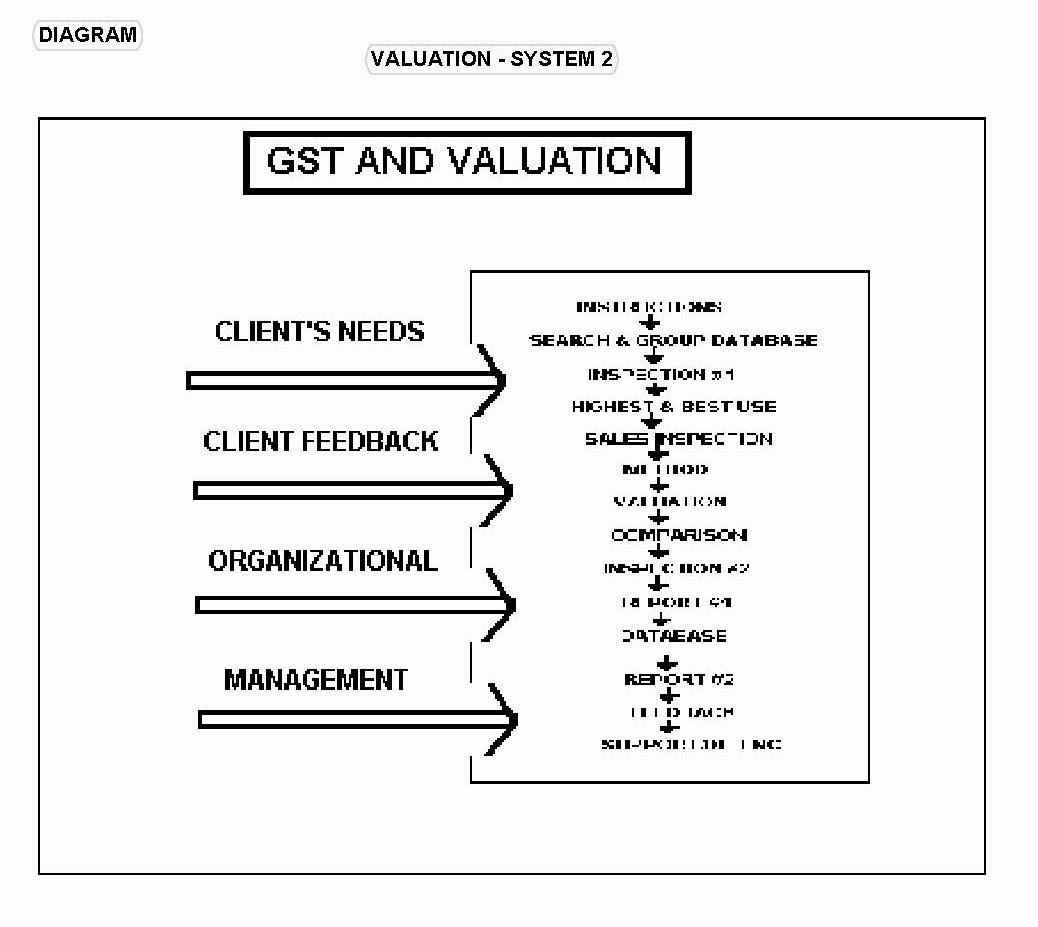

The process is better illustrated by the second diagram below where the

valuer's perspective has been reduced to "system one" and is subject to

the outside perspectives and environments in "system 2". For example,

the type of valuation report is determined largely by the needs of the

client. If the client is part of the private sector and requires a

valuation report for an application for mortgage funding then the

valuation firm will respond with a speaking (full) report. On the other

hand if the client is within the same organization, a brief one page

statement of value may be sufficient. There is a tendency

for complex organizations to achieve greater differentiation and

specialization among internal subsystems. For example, in a large

valuation firm, specializations appear such as industrial or commercial

departments.

SUBSYSTEMS OR

COMPONENTS

A system by

definition is composed of interrelated parts or elements. This is true

for all systems are composed of interrelated parts or at least two

elements, and these elements are interconnected. Systems exchange

information, energy, or material with their environments. the more open

the system, the greater is such exchange. Feedback from the valuation

client is most important in the valuation system.

The concept of

feedback is important in understanding how a system maintains a steady

state. Information concerning the outputs or the process of the system

is fed back as and if there is deviation from a prescribed course, the

system then readjusts to a new steady state. For example, a valuation

firm may adjust the wording of valuation disclaimers following the

result of a recent court decision. Interaction with the environment

goes further than that shown in the diagram below.

Law, society

(values), science and economics are all powerful environments which cut

across subsystem two.

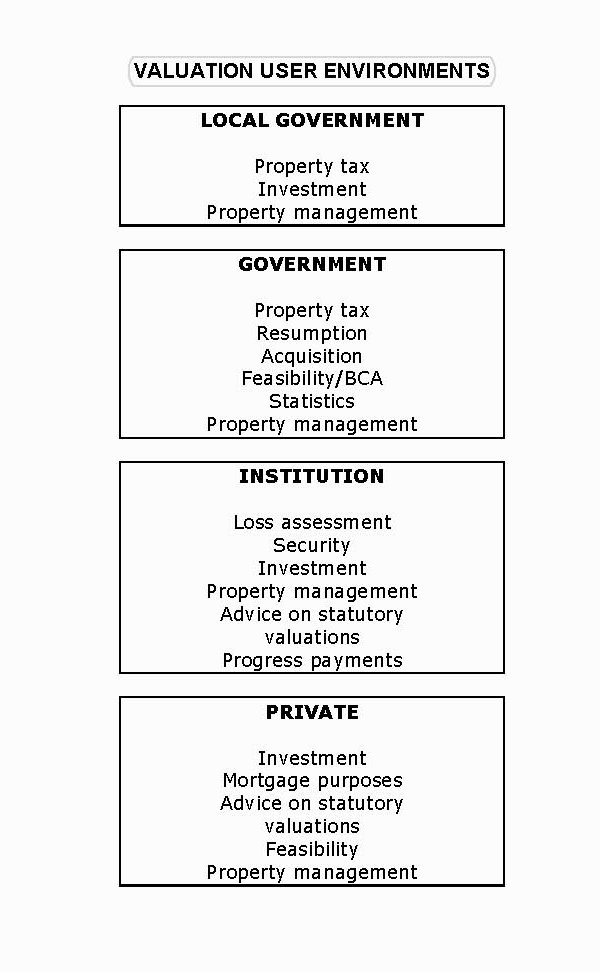

The outside

environment shown in the last diagram is most important. For example,

social values require that a good property tax system is one that is

easily understood by the consumer (the taxpayer) and that there is an

effective appeal process subject to the decision making environment of

the courts. This is why property taxes cannot be wholly replaced by

indices or some proxy to market value derived by computer.

As the legal

environment is the final and ultimate umpire, their rules cannot be

ignored. The valuer must be able to prove his/her valuation in court.

That is why the valuer cannot be replaced by the computer and why

research tools such as multiple regression analysis (MRA) can never

become anything more than a support or secondary method of valuation.

Society, consumers, clients and the courts will not allow it as a

primary method of valuation.

Once the "big

picture" provided by GST is appreciated it can be seen that in many

valuation processes the "tail wags the dog". For example, the consumer

of a property tax valuation demands certain valuation criteria which

the law and governments try to provide. For example, a circuit breaker

that provides relief to certain groups seen to be subject to property

taxes that are too high.

The extended

valuation system shown in the diagram below can be further extended.

For example, international law is playing an increasingly important

role in the maintenance of the environment and a large amount of

Federal jurisdiction in land management is achieved through the signing

of international treaties.

With better and better communications

certain world systems will have a greater bearing on the Australian

valuation system.

LEGAL CONTROLS

All states and

territories except South Australia and the ACT have legislation

controlling the activities of real estate valuers particularly by way

of licensing.

7