| NUMBER | TOTAL FIXED COST‘000 | TOTAL VARIABLE COST‘000 | TOTAL COST

'000 |

| 1 | 50 | 30 | 80 |

| 2 | 50 | 37 | 87 |

| 3 | 50 | 43 | 93 |

| 4 | 50 | 50 | 100 |

| 5 | 50 | 60 | 110 |

| 6 | 50 | 72 | 122 |

| 7 | 50 | 87 | 137 |

| 8 | 50 | 106 | 156 |

| 9 | 50 | 131 | 181 |

| 10 | 50 | 161 | 211 |

| VARIABLE INPUT

(LABOUR) |

$ VALUE OF VARIABLE

INPUT (LABOUR) ‘000 |

$ VALUE OF FIXED INPUT

(MAN’MENT) ‘000 |

TOTAL INPUT

(TOTAL COST) ‘000 |

COMMODITY

(HOUSES) |

| 5 | 150 | 180 | 330 | 1 |

| 11 | 200 | 180 | 380 | 2 |

| 17 | 255 | 180 | 435 | 3 |

| 23 | 310 | 180 | 490 | 4 |

| 30 | 370 | 180 | 550 | 5 |

| 37 | 430 | 180 | 610 | 6 |

| 45 | 495 | 180 | 675 | 7 |

| 55 | 565 | 180 | 745 | 8 |

| 66 | 640 | 180 | 820 | 9 |

|

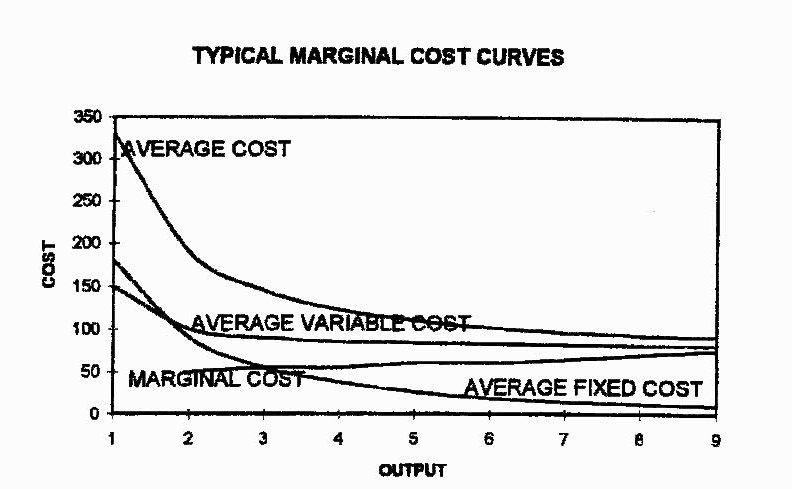

QUANTITY (HOUSES) |

AVERAGE COST (COST PER HOUSE) ‘000 |

MARGINAL COST ‘000 |

|

1 |

330 |

50 |

|

2 |

190 |

55 |

|

3 |

145 |

55 |

|

4 |

122.5 |

60 |

|

5 |

110 |

60 |

|

6 |

101.7 |

65 |

|

7 |

96.4 |

70 |

|

8 |

93.1 |

75 |

|

9 |

91.1 |

|