FEASIBILITY STUDIES – ANZ NOTE

1.0 Introduction

1.1 Purpose

The purpose of this guidance note is to provide Members with a framework in which to conduct and prepare feasibility studies and determine the viability of undertaking development of real estate.

1.2 Status of Guidance Notes

Guidance notes are intended to embody recognised ‘good practice’ and therefore may (although this should not be assumed) provide some professional support if properly applied. While they are not mandatory, it is likely that they will serve as a comparative measure of the level

of performance of a Member. They are an integral part of ‘Professional Practice’.

1.3 Scope of this Guidance Note

This guidance note covers the preparation and collection of relevant information, the evaluation of development potential, the estimation of development costs, the valuation of the development on completion and the profit margin and rate of return. It should be used in conjunction with other guidance notes and Practice Standards, which are either over-arching or directly applicable to the type of property, purpose or issues involved.

1.4 Feasibility Study

For the purpose of this guidance note, a ‘feasibility study’ is defined as the process of undertaking an assessment to identify the opportunities and risks of a property development project and to estimate the projected costs, revenues and profit potential of the project. This guidance note assumes the feasibility study to be in a full report

format, clearly describing the project in all respects and it should include a financial feasibility, using either a static analysis, dynamic analysis or discounted cash flow method of analysis.

1.5 Static Analysis

Static Analysis - With this approach costs are generally summated as at the date of completion of the project and income is assessed as at the same date with allowances for vacancies and letting up periods.This is the less complex financial analysis which is suitable for preliminary feasibility studies and for calculating profit and risk or land value.

A ‘static analysis’ assumes no change in prices or costs during the period of development.

1.6 Dynamic Analysis

Dynamic Analysis – allows for potential movements in prices and costs over the period of the development.

1.7 Discounted Cash Flow Method

Discounted cash flow method - With this approach, both costs and income are assessed over an appropriate time period and then discounted back to present value, generally being the date of the commencement of the project. This is the more complex financial analysis that should include interest rate calculations based on a 100% funded basis (an equity basis may also be included if required).

1.8 Terminology and Principles

The terminology used in this guidance note generally reflects commercial development schemes for investment purposes, but the principles apply equally to owner occupied schemes, to residential developments and developments for other non-commercial uses.

2.0 General Considerations

2.1 Choice of Comparables

The preparation of a feasibility study generally relies on comparison of unit costs and rates from similar development schemes which are then applied to the particular development to be analysed. In using this approach, reasonable care must be taken in the choice of comparables to ensure that unit rates for other schemes do not reflect particular circumstances (e.g. exceptionally poor ground conditions, grossly different building specifications, different planning constraints). Equally, particular circumstances pertaining to the feasibility study being prepared should be carefully considered and reflected in the feasibility analysis.

2.2 Number of Variables

In preparing a feasibility study, the number of variables to be considered is large and the Member should be aware of the errors which may arise from using comparable transactions which require a significant number of adjustments.

If an attempt is made to adjust for too many variables, the usefulness of the comparison may be destroyed.

2.3 Time and Program Constraints

In large, phased schemes the Member should have regard for time and program constraints and should make use of discounted cash flow techniques if appropriate.

2.4 Sensitivity Analysis Using Alternative Assumptions

The Member should state clearly the assumptions made and should be in a position to justify them by reference to evidence, research and sound reasoning. If a particular variable cannot be assessed objectively, it will often be appropriate to undertake and provide a sensitivity analysis demonstrating the results that would flow from using alternative assumptions for that variable.

2.5 Purpose of Feasibility Study

Any feasibility study to establish site worth that takes account of the client’s specific circumstances cannot purport to be an open market assessment. There is an important distinction between an assessment for the purpose of establishing Market Value and one carried out for specific purposes (e.g. to determine how much to bid for a site).

The Member should ensure that the instructions are clear as to the purpose of the feasibility study.

2.6 Limitations of Residual Valuation Process

The Member should, therefore, be wary of presenting the estimate of site worth arising from a residual valuation approach pertaining to a feasibility study as a precise statement of value. If the instructions permit, it may be preferable to indicate a range of values. In any event the Member should ensure that the client is aware of the limitations of the residual valuation process for development property and should indicate the areas in the calculation carrying the greatest sensitivity.

3.0 Agreeing Scope of the Feasibility Study with the Client

3.1 Discuss Client’s Requirements

Before proceeding with the feasibility study, the Member should discuss and confirm the client’s requirements to formulate the brief, i.e. obtain full and proper instructions from the client as to the extent of the feasibility study, the scope of the development and the scope of ervices to be provided by relevant parties

3.2 Concept Plans

The concept plans of the proposed development on which the feasibility study is based need to be clearly agreed with the client.

3.3 Changes to Scope of Development

During the feasibility study, information may come to hand which justifies changes to the scope of the development.

Any changes in scope or changes in assumptions applicable to the feasibility study must be agreed in writing with the client.

4.0 Methodology

4.1 Elements in a Feasibility Study

This and the succeeding paragraphs of this guidance note focus on the individual elements in a feasibility study.

4.2 Stages in Study

The stages in undertaking a feasibility study may besummarised as follows:

• obtaining written instructions agreeing the scope of the development with the client including pre or post taxation assessment and depreciation considerations;

• preparation and collection of information;

• evaluation of development potential;

• estimating development costs;

• assessing value on completion; and

• determining profit margin and rate of return.

4.3 Guidance Note Not Exhaustive

This Guidance Note should not be taken as exhaustive and the Member is responsible for ensuring that all relevant factors are taken into account. The Member should retain satisfactory records to support assumptions made and data used in the evaluation process, to provide an ‘audit trail’ should it prove necessary to justify the results.

4.4 Level of Detail

The level of detail which is practical, when assessing development potential and costs, will vary according to the circumstances of the feasibility study. This Guidance Note assumes that a comparatively high level of accuracy is to be achieved. The Member will need to make a

judgement (perhaps in consultation with the client) as to what is appropriate in each case. If information obtained from other consultants or experts (architects, quantity surveyors, leasing agents, valuers, etc) is relied on, the Member should identify the source and state the information on which he or she has relied.

5.0 Preparation and Collection of Information

5.1 The Development Site

Inspection will familiarise the Member with the subject property and will establish a strong visual reference to any matters which affect either value or cost. In the case of development properties, referencing should include, where relevant and practical, the following:

• drawings showing the buildings or site, or measurement of site or buildings to ascertain frontage, width, depth and built measurements;

• shape of site and ground contours;

• plot ratio and site density evaluation;

• existing building height and that of adjoining properties;

• efficiency of existing building (if to be retained);

• access;

• party wall, boundary and rights of light issues;

• ground conditions and evidence of contamination;

• availability and assessment of services; main drainage,

water, gas, electricity and telephone;

• any evidence of the existence of rights of way, easements, encumbrances, open water courses, mineral workings, filling, tipping, etc;

• any matters which will affect the cost or practicality of the construction process (e.g. poor access, cramped site conditions); and

• sources of all relevant material used to establish underlying assumptions, e.g. building plans and specifications provided by building consultants.

If any of this information is unavailable or cannot reasonably be obtained, the Member should state what assumptions have been made.

5.2 Third Party Interests

In brief, the Member should investigate the following factors which may affect value and the practicality of development:

• the extent and nature of the client’s interest in the project;

• other interests in the property (actual or implied by law) including leases and other rights of occupation; and

• easements, restrictive covenants, rights of way, rights to light, drainage or support, registered charges, etc.

5.3 Planning and Other Statutory Requirements

The Member should investigate a range of issues relating to planning permission and policy and statutory controls.

5.4 Planning Permission

A feasibility study may be requested on the basis of an existing planning permission. In other circumstances, it will be necessary to form a view as to the best permission of which there is a reasonable prospect, and the cost of complying with any planning agreements likely to be required in order to secure the permission. Depending

on market conditions, it may be appropriate to discount the site value to reflect the risk of not obtaining such permission and/or the delay that might be caused if it were to prove necessary to appeal against refusal or the imposition of conditions.

5.5 Planning Policies

Planning policies are also relevant in that they control future additions to the supply of particular types of building. They may, therefore, affect the Member’s opinion of the potential supply of competing buildings and hence the letting or sale period, future rental or price prospects

and investment yields.

5.6 Particular Issues

Particular attention is drawn to the following issues:

• current planning policies, i.e. zoning/Planning Area and use controls, affecting the subject site and surrounding area. Normally, these will be found in Regional and Local Authority statutory plans; supplementary

guidance prepared by the local authority planning officer or an independent Town Planner may be appropriate and prudent;

• any existing valid permission and related conditions or reserved matters;

• the requirements of any legally binding agreements with statutory authorities;

• any special controls that may apply, e.g. heritage restrictions, heritage listing of buildings, conservation area designation, tree preservation orders;

• permitted and non-conforming use approvals relating

to existing buildings (if to be retained);

• environmental protection legislation (e.g. noise abatement, control of emissions, requirements for asbestos removal);

• building regulation requirements (e.g. sprinklers, fire escape arrangements, etc); and

• special/specific statues and regulations affecting the particular type of development proposed.

5.7 Development Program

An outline program will be required covering:

• preparation and agreement with client of concept plans for the proposed development;

• the pre-contract period; site assembly, obtaining possession, adjoining owner negotiations, the planning process, architectural and engineering design to the required level, soil investigations, the building contract tender period, etc;

• the building contract, including demolition and any necessary site preparation (it may be appropriate to seek advice from a quantity surveyor, engineer or architect); and

• the post-contract period - usually defined as the period up to the full letting or sale of the completed development.

6.0 Evaluation of Development Potential

Optimum Balance Between Market and Potential In order to evaluate the development options, the Member will need to consider both the market requirements for the proposed development and the physical potential of the site and will need to determine the optimum balance to maximise the return. The Member should also consider whether there is scope for enhancing the development potential of the site by merging it with adjacent land.

Conversely, if it is necessary to acquire adjacent land or rights over it (e.g. for access), allowance will have to be made for the cost of such acquisition. It must be recognised that, in the absence of compulsory purchase powers, it may prove very difficult or expensive (or perhaps even impossible) to acquire such rights and the Member should draw attention to such risks in relevant cases.

6.1 Form of Development

The Member will need to make an accurate assessment of the form and extent of physical development which can be accommodated on the site, having regard to the site characteristics and the likelihood of obtaining permission.

This assessment may be undertaken in consultation with appointed project consultants, such as architects and quantity surveyors but, if this is not possible, the Member will have to make an independent assessment. The Member should take into consideration and balance the requirements of:

• occupiers’ preferences for particular design features, building layouts and specification;

• investors’ requirements;

• the time likely to be taken to produce the new buildings, in relation to market requirements, financing and cost; and

• achieving a high efficiency ratio (net internal area expressed as a percentage of the gross external area) without unduly compromising quality.

6.2 Demand and Market Analysis

The Member will need to analyse the market, both current and projected, for the proposed new buildings, in order to provide his or her best view of occupier demand for the alternative forms of development that may be possible.

Such assessment requires an understanding of economic, fiscal and social trends at national, regional and local level, to the extent that they affect occupier demand for specific types of property at a time relevant to the date that the completed development is due to be marketed. Occupier demand will be influenced by many factors, which are likely to include:

• the location of the property;

• access;

• the availability of transport routes;

• car parking facilities;

• amenities attractive to tenants and/or purchasers;

• the size of the development in terms of lettable

packages;

• form of development;

• incentives that may apply currently or in the future that may affect the viability of the project; and

• market supply, including actual or proposed competing developments.

7.0 Estimating Development Costs

7.1 Land Cost

The land cost should generally be established by reference to actual cost or by reference to comparable land sales.

In some instances, the aim of the feasibility study is to establish land worth by calculating the residual land value after deducting cost of development from value created.

Land cost should include ancillary costs such as purchase fees, stamp duty, etc. If the development is to be carried out in stages, the implications for the cash flow and the various categories of cost should be considered.

7.2 Site-Related costs

Costs incurred in obtaining vacant possession, acquiring necessary interests in the subject site or adjacent property, extinguishing easements or removing restrictive covenants, rights of light compensation, etc. The allowance should be realistic, recognising the fact that the other party will expect to share in the development value generated by the site assembly.

7.3 Building Costs

Estimated costs relating to the construction of the buildings, which should include preliminary survey and investigations, soil testing, demolition, temporary protection and enabling works, hoardings, public utility works, diversion of services, works to adjoining sites, other interested parties’ accommodation works, highway improvements, etc.

The accuracy with which costs can be assessed will vary greatly with circumstances. Members should be aware that the use of ‘rules of thumb’ to estimate costs will compromise the accuracy of the building cost estimate.

Ideally, an estimate should be prepared by a quantity surveyor.

A decision has to be made as to whether to adopt a projected out-turn cost (i.e. including increases due to inflation, comparable to a fixed price contract) or a ‘dayone’ cost (i.e. comparable to the initial contract sum in a fluctuating price building contract). It may be necessary also to consider the effects of any time lapse between the valuation date and the likely placing of the building contract. For further comments on this see GN 1: 8.0 below. In general, it is advisable to consult a quantitysurveyor if any projection of costs is contemplated.

7.4 Professional Fees and Expenses

The costs relating to the appointment of professional consultants to secure procurement of the building.

The number and type of consultants, and nature of their appointment, will depend upon the building procurement method chosen. It will normally include an architect, a quantity surveyor and a structural engineer with additional specialist services being supplied as appropriate by mechanical and electrical engineers, a landscape architect, traffic and civil engineers, an acoustic consultant, a project

manager and others. More specialised disciplines may be required depending on the nature of the development and allowance for these should be reflected in the assessment of fees. Expenses and costs excluded under the normal conditions of appointment should be added where necessary (e.g. models, printing). Fees vary significantly according to the size and nature of the project and the Member should take care to reflect current fee levels for the type of project envisaged.

7.5 Letting Expenses

The costs to be incurred in securing tenants for the completed buildings, generally comprising letting agents’ fees and promotion costs (possibly including a show suite). An allowance should be included where necessary for capital contributions or other inducements needed in order to secure lettings, unless these are discounted in the letting terms assumed.

7.6 Legal Costs and Fees

Costs incurred for legal advice and representation in connection with such matters as site acquisition, town planning, building contract matters, occupational leases (unless assumed to be recoverable from the tenant) and raising finance.

7.7 Planning and Building Regulation Cost

The cost of securing planning permission (development approval), a building licence and concluding any agreement under relevant Town Planning Acts. It may be appropriate to allow for a model and the cost of a planning appeal if one seems likely.

7.8 Cost of Raising Finance

Costs related to the raising of development finance, including professional fees for monitoring draw-downs vis a vis construction progress.

7.9 Holding Costs

The total attendant costs (excluding interest) in holding the completed building up to the assumed date of letting, including such items as insurance, security, cleaning and fuel (or a proportion of the service charge on partly let properties) together with rates and taxes.

7.10 Sale Costs

Costs to cover the developer’s sale fees (agents and legal costs) if the sale of the completed development is intended or assumed. The costs of the purchaser are usually allowed for in the valuation of the completed development, but forward sale agreements may contain different provisions.

7.11 Interest Charges

Interest

charges reflecting the actual or assumed financing arrangements

for the development and the projected program

during the pre-contract, contract and postcontract stages.

For the purposes of the development appraisal, it is usual to make an

allowance for short-term finance during the development period on the

assumption that the completed and fully let development will be sold

or long-term finance will be obtained on its transfer to

the

developer’s investment portfolio.

It is normal for interest to be treated as a development cost up to the assumed letting date, unless a specific forward sale agreement dictates otherwise. Appropriate assumptions will have to be made regarding cash flow and the rate of draw-down. The rate of interest adopted should be based on realistic assumptions both as to the finance market and the status of the developer (whether the Client or a hypothetical purchaser).

8.0 Value ‘As if Complete’ and ‘At Date of Completion’

Capital Value ‘As if Complete’ or Net Rental Income The Member may require the services of a qualified valuer for this aspect of the feasibility study, depending on the nature of the study and the parties for whom it is intended. Depending on the profit criterion used (see below) it will be necessary to estimate either the capital value ‘as if complete’ and/or the net rental income likely to be generated by the completed development. In addition to the usual considerations relevant to such valuations, particular issues arise which are peculiar to development schemes.

8.1 Capital Value

If a capital value is required, it is normal to assume that the building is let and income producing, due allowance having been made in the assessment of development costs for the expenses incurred in achieving the letting(s) and for the finance and other costs of holding the property during the letting period. Rent-free periods granted under the lease are dealt with variously, e.g. by continuing interest charges on the development costs, by treating the ‘lost’ income as a development cost or by taking account of the rent-free period in the valuation of the completed development. The Member should be aware that the appropriate approach towards voids and rent-free periods may be dictated by financing or forward-sale agreements and should seek information from the Client where appropriate. If the objective of the feasibility is to make an open market assessment of capital value, the appropriate approach would be to take account of rent free periods in the valuation of the income stream likely to be generated by the development.

8.2 Take Account of Delay

Unless the development has been pre-let and/or pre-sold on fixed terms, the Member will not only have to make those normal assumptions which are required in every vacant possession case, but will have also to decide how to take account of the delay between the date of the study and the date on which the eventual letting is expected to take place. The Member should have regard for market conditions at the date of the study and the factors that may cause changes in the future, e.g. supply and demand, inflation, interest rates, etc.

8.3 Sensitivity Analysis

The Member may wish to present an appraisal based on provable values with a sensitivity analysis to show the effect on profit of differing assumptions as to the future rent and yield. The Member should aim to assist the Client in assessing the likely value on completion, by reference to present and future market trends and likely shifts in supply and demand.Wherever possible, the treatment of these issues should be discussed with the Client.

8.4 Potential Changes in Rental Values, Yields and Costs

The treatment of potential changes in rental values and yields, may be influenced by the extent to which potential cost changes are also reflected, particularly the effect of inflation on building costs, but also likely changes in interest rates. Rather than attempt forecasts, it may be appropriate to adopt a ‘current rent, current cost’ approach, but it is advisable to accompany this with a sensitivity analysis to show the effect on site value of differing assumptions as to future rents, yields and costs. In any event, unless the Member’s instructions specify the basis to be adopted he or she should familiarise himself or herself with common practice at the time of the valuation and adopt a method of valuation, which is consistent with market conditions.

8.5 Estimated Value at Date of Completion

It should be noted that the estimated value on completion should not be discounted back to the valuation date. The inclusion of interest charges within the development cost makes the completion of development the date at which cost and value are to be compared.

8.6 Distinction

Value ‘on completion’ or ‘at date of completion’. reflects the anticipated value of the project at the time the project is actually completed. This is in contrast to a value ‘as if complete’ which assumes the project to be complete at the date of the assessment or feasibility study. It is appropriate to clearly state which basis the assessment has been made on and to provide an appropriate explanation (as well as assumptions and limitations).

9.0 Profit Margin and Rate of Return

9.1 Profit as a Percentage of Total Development Cost

When using the residual method to establish the development site value, it is usual to assume that the developer will seek a capital profit expressed as a percentage of the total development cost (including interest) or of gross development value. This derives from the traditional financing arrangement whereby the development is sold on completion to a long-term investor.

It is also common practice for development companies, which retain completed schemes in their investment portfolios to judge the success of a scheme in terms of the enhancement of the balance sheet (net asset value) rather than the profit and loss account (income).

9.2 Other Criteria

There are, however, other criteria that are sometimes adopted, whether as a substitute for profit yield or as an additional test of profitability. These include:

9.2.1 Initial yield on cost

The net rental return calculated as the initial full annual rental on completion of letting expressed as a percentage of the total development cost. This criterion may be significant in establishing whether the developer could service a long-term mortgage loan, or for evaluating the effect of the development scheme on the profit and loss

account of a company.

9.2.2 Cash-on-cash (or Equity Yield)

The capital uplift or (more usually) net income (after interest charges on any long-term mortgage loan) expressed as a percentage of the long-term equity finance provided by the developer.

9.2.3 Discounted Cash Flow Methods

The income stream is projected with explicit assumptions about rental growth and end sale value and discounted back to a net present value (NPV) using an appropriate discount rate. The scheme is deemed viable if NPV exceeds the total development cost. The discount rate should include an allowance (profit margin) for the management requirements and risk of investing in a development project rather than an existing fully let property. This approach is particularly appropriate for

large, phased schemes.

9.2.4 Internal Rate of Return

A variant of GN 1: 9.2.3 in which the yield is defined as the discount rate that equates NPV with total development cost.

9.2.5 Amount of cover

The extent to which the rent or sale price can be reduced, or the letting or sale period extended (often expressed as a number of months of rolled-up interest or loss of rent) without suffering an overall loss on the scheme.

9.2.6 Transition from Non-Viable to Viable

If an appraisal is carried out in the course of advising a Client, it will be appropriate to seek instructions on both the nature of the criteria to be adopted and the critical value, which, to that Client, represents the transition from non-viable to viable. Where this guidance is not available, the Member will have to exercise his or her own judgement, based on experience.

9.2.7 Capital Profit Test or Alternative Criterion

Traditionally, the capital profit test has been the most widely used. However, the Member should acquaint himself or herself with common practice among developers and should be prepared to consider and, if appropriate, adopt an alternative criterion if experience shows it to be in wide use.

9.2.8 Developer’s Level of Profit

The level of profit to be assumed in the appraisal cannot be specified as a standard, as market requirements will vary from time to time having regard for the nature of the development. Evidence may be deduced (possibly with difficulty) by analysing transactions, but is better obtained by first-hand experience of developers’ requirements.

9.3 Appropriate Profit Influenced by Risk Profile

In any event, it must be recognised that the appropriate profit to be expected from a particular development will be influenced by a number of factors, which might lead to a departure from the market ‘norm’. High amongst these will be the general risk profile (e.g. whether or not rentsand cost are inflated, whether the interest rate is fixed, whether the scheme is pre-let or pre-sold) but also relevant will be the scale of the development, the amount of financial exposure and the time scale.

REPORTING

Feasibility Study Checklist

It is recommended that a feasibility study report make reference to the following checklist of items. There may be circumstances where not all headings need to be included in the report, but the Member should be satisfied that the omission of a section will not mislead or distort the findings of the feasibility study.

Basis of Appointment:

• The person/party for whom the feasibility study is being prepared.

• Details of the instructions including any special conditions and/or assumptions.

• The date and basis of the feasibility study

• The purpose of the feasibility study.

Land Description:

• Title details (including title searches).

• Registered proprietor.

• Encumbrances.

• Lease details.

• Details of any options, conditional contracts, etc Location

• A general description of the location of the property, transport, shopping, etc.

• Surrounding development and land use.

• Special features such as views, etc.

Site Details:

• Dimensions.

• Area.

• Services (water, sewer, drainage, electricity, gas, and communication) detailed analysis of the availabilityand location of services, relevant authorities, any special problems, etc.

• Geo-technical, filled ground, landslip.

• Flooding.

Planning and Other Statutory Requirements:

• Details of current zoning/planning area and allowable uses under statutory planning legislation.

• Details of any existing planning approvals on the site.

• Detailed analysis of all relevant planning requirements affecting the proposed development.

• Heritage details (if applicable).

• Comment on the local community and political environment and the affect this could have on the project.

• The requirements of any legally binding agreements with statutory authorities.

Existing Improvements:

• A detailed description of any existing improvements including any compliance problems with the Building Code of Australia (NZ Building Act 2004) and statutory authorities.

• Any comments in relation to demolition, site access, cramped site conditions, etc.

Environmental Audit:

• Full history on the types of uses the property has been used for.

• A detailed analysis of any contamination issues including Environmental Assessment by an independent consultant where available. Reference should also be made to the Institute’s Guidance Note GN15 Reporting on Contaminated Land.

Evaluation of Development Potential:

• Market potential (supply and demand)

• Physical capacity of the site.

• Planning controls on the site, e.g. plot ratio, car-parking controls.

• Potential for merging with adjoining sites.

Proposed Development:

• Detailed description of the proposed development, which is the subject of the feasibility analysis.

• Details of any development approvals, building approvals, subdivision plans, etc.

• Comments on proposed Design and Finishes.

Development Program - an outline program will be required covering:

• Concept approval by client

• Site Assembly

• Design documentation

• The building contract period

• Period for letting up or sale of completed development.

Demand and Market Analysis:

• General economic influences

• Market supply, including actual or proposed competing developments.

• Historic and projected demand.

Estimating Development Costs:

• Land cost

• Site-related costs

• Building costs

• Professional fees and expenses

• Letting expenses

• Legal costs and fees

• Planning and building regulation costs

• Cost of raising finance

• Site holding costs

• Sale costs

• Interest charges.

Income Estimate:

• Assumed letting up period

• Rents

• Tenancy incentives, e.g. rent free periods, etc.

Capital Value Estimate:

• Capitalisation rates (static analysis)

• Discount rate (discounted cash flow analysis)

• Comparable market evidence.

Profit Margin and Rate of Return:

• Developer’s risk and profit margin

• Initial rental yield on cost

• Return on capital

• Capital Profit (cost vs value created)

• Internal Rate of Return

• Comparison with normal market returns.

Sensitivity Analysis:

The Member may carry out a sensitivity analysis to test the financial assumptions.The results of the sensitivity analysis should be clearly set out in this section of the report.

Conclusion and Recommendations:

The Member should summarise the results of the feasibility analysis in terms of the original brief and instructions.

Sample Disclaimers

The following disclaimers are illustrative samples for consideration for inclusion in any Feasibility Study report:

It must be recognised that the real estate market and building industry fluctuate with market forces. The results of this feasibility study are based on the information available as at the date of this report and the assumptions stated in this report. Reliance after an extended period from the date of this report or reliance on the findings of this report for modified development plans should only be made after written confirmation that it is appropriate to do so by the Author.

Information furnished by others, upon which all or portions of this report are based, is believed to be reliable but has not been verified in all cases. No warranty is given as to the accuracy of such information.

This report is for the use only of the party to whom it is addressed ........... (instructing party nominated) and is for

......................... (reason for the feasibility study) purposes and no other purposes. Under no circumstances will responsibility be accepted to any third party who may use or rely on the whole or any part of the contents of this feasibility study.

Any third party wishing to use this report should obtain prior written approval from ............................ (name of author or firm preparing the report).

Attachments:

• Financial feasibility.

• Development approvals and plans.

• Title searches.

• Planning certificates.

• Surveys (building and site).

• Services diagrams (sewer, etc).

• Any appropriate documentation supporting assumptions.

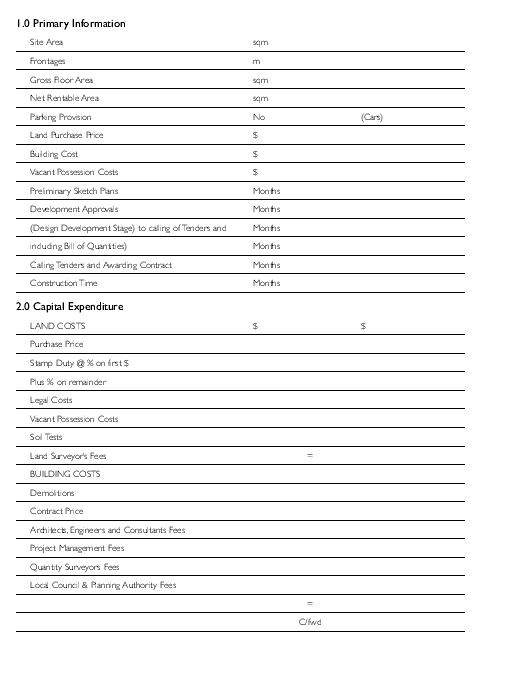

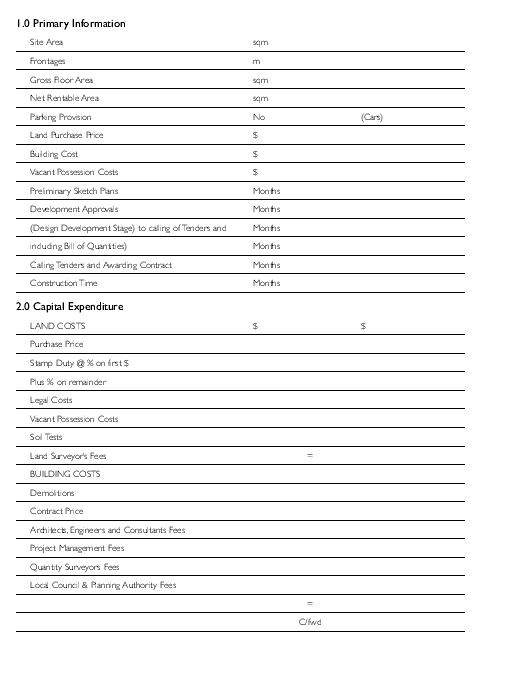

WORKSHEETS

Feasibility Studies

The purpose of feasibility studies is to calculate the return that will be derived from a particular project.

The return can be expressed as an annual percentage return or as a terminal percentage return. An annual percentage return will be used where the project will be generating rent for the owner, while a terminal return is used when the project is to be sold.

The calculated returns are important only for comparisons, i.e. to compare one project with another or to compare one project’s return with the return that would be achieved by investing elsewhere.

The following pro-forma represents a suggested set out to calculate the return. Item 3.0 is shown in alternative forms. The first alternative is applicable to an annual return and the second to a terminal return.