It is possible to a construct the PVPMT factor having a required return on investment different from the sinking fund or replacement of capital rate. Such a factor is known as a DUAL RATE FACTOR (DRF) (in overseas textbooks, the dual rate method of valuation is known as the Hoskold method).

Dual rates are used in the following valuations:

where the property investment is one of very high risk, so that the investor requires a much higher rate of return compared to the replacement of capital rate.

where there is depreciation or obsolescence of the asset is so high that at the end of a short life, the asset has nil value. At the same time, there is no compensatory benefit such as capital gains on the land value.

sub lease investments where the investor has zero interest in the property at the end of the lease period.

EXAMPLES

sale and leaseback or purchase and leaseback

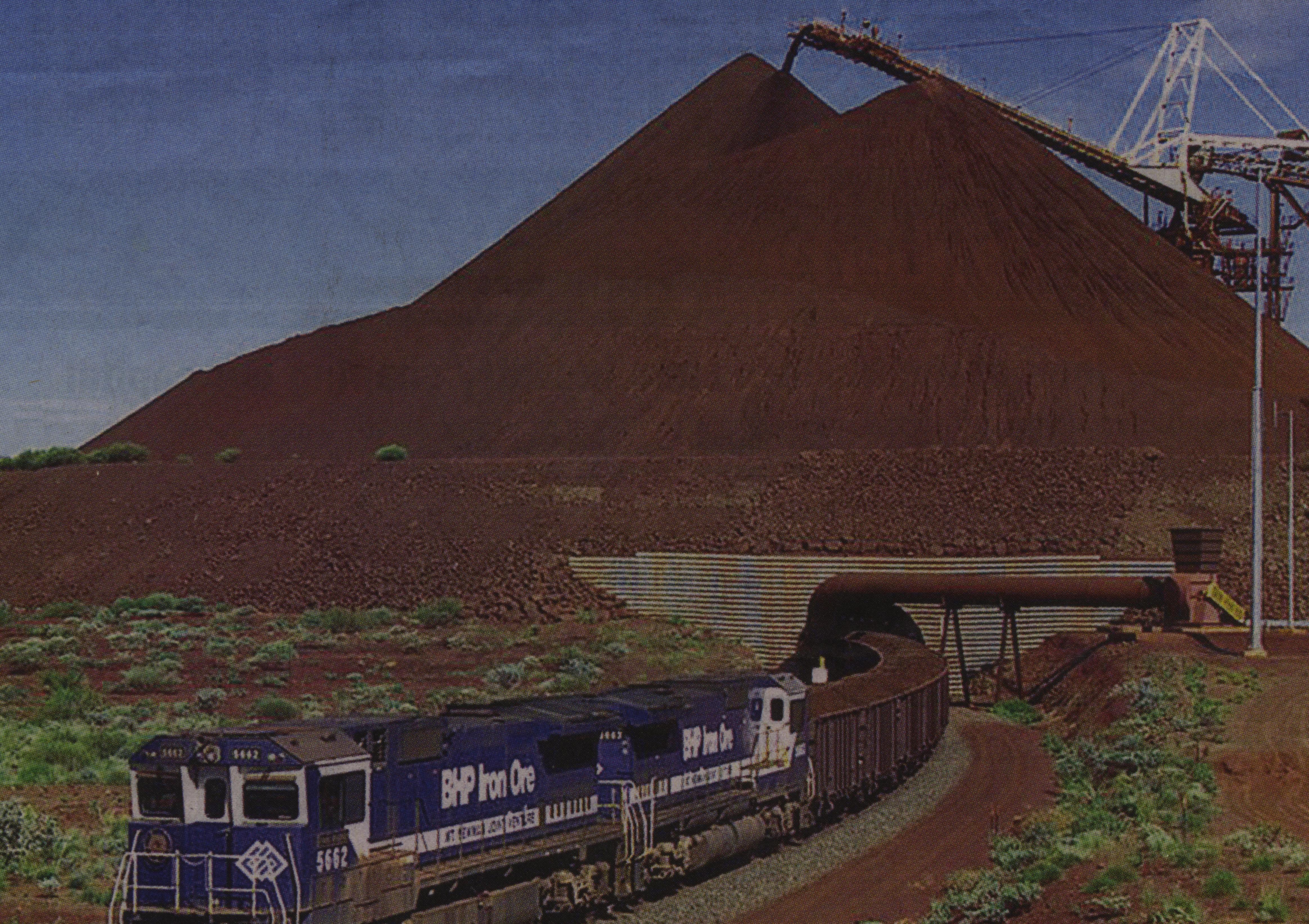

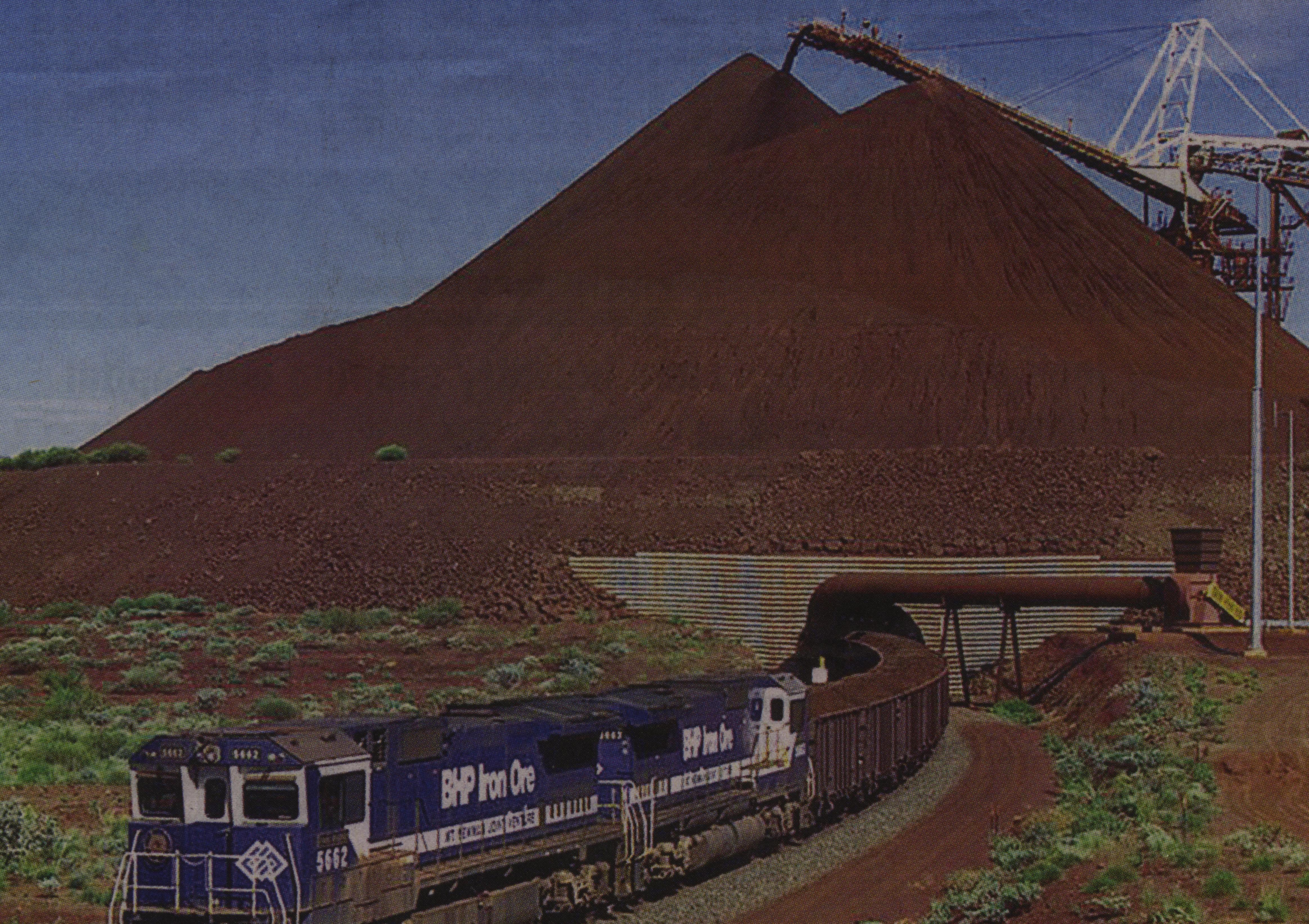

extractive industries such as quarries and mines.

ground and head leases.

AT THE END OF THE LIFE OF A MINE – THE ASSET HAS NIL VALUE BEING ONLY A HOLE IN THE GROUND

Compare these land uses with for example, an office block. At the end of the long life of the office block assuming a growing economy, the total asset (land and building) has a value much higher than the original investment because of capital gains enjoyed arising from increases in the land value. Therefore, in such a case the replacement of capital component in the required annual return is not important as the investment capital is not lost.

On the other hand, of the end of the life of a quarry in a remote location there is only a hole in the ground. There has been a complete loss of the mineral asset. Therefore, when valuing a quarry, special provision must be made for the replacement of capital using dual rates.

CONSTRUCTION OF THE DUAL RATE FACTOR (DRF) QUARRY EXAMPLE

The investor in a brick clay quarry requires a 25% per annum return on investment but is able to replace capital in a 15% pa account. If the quarry has an expected life of 10 years and the expected average net annual income is $100 000 per annum, it’s value can be determined as follows:

STEP 1

Determine the Dual Rate Factor:

Sinking fund factor (SFF):

B = 1.15

FV = 4.046

FVPMT = 20.30

SFF = (1/FVPMT)= 0.0493

ADD required return on investment:

+0.2500

-----------

TOTAL: 0.2993

DUAL RATE FACTOR:

= 1/0.2993 = 3.342

That is, the required annual return for every $1 invested in the quarry is $0.2993.

STEP 2 DETERMINE THE VALUE OF THE QUARRY

The expected average net annual income from the quarry is $100 000 per annum:

100 000 * 3.342 = $334200 say $334 000

PROOF

The investor pays $334166 (after allowing for rounding error) for the right to receive $100 000 per annum.

The required return on investment:

25% * 334166 = 83 542 pa

100 000 83 542 = $16458 pa

The excess is for the sinking fund contribution.

SINKING FUND REPLACEMENT OF CAPITAL

FVPMT = 20.30

FVPMT(16458) = 334 097 say $334 000

INCOME TAX ADJUSTMENT

For dual rate valuations, the replacement of capital is most critical and therefore, it is common to adjust the sinking fund factor for tax payable on the interest earned.