Self managed superannuation funds comprise 20% of the superannuation industry and, at 31 December 2003, had approximately $125 billion in assets under management. There are around 300,000 self managed super funds, and the number of funds is growing at about 2,500 a month.

An average of 160 self managed super funds close each month.

The average account balance of a self managed super fund is $235,000.

The membership spread among self managed super funds is:

-

One member 21%

-

Two members 65%

-

Three members 7%

-

Four members 7%

SUPERANNUATION AND THE AUSTRALIAN RETIREMENT INCOME SYSTEM

Superannuation is a savings arrangement whereby employers, employees, people who are self-employed, and family members (on behalf of their spouse or children) contribute over a long period to a superannuation fund. The superannuation fund holds the contributions in trust for members and invests these contributions to increase the fund’s assets. These assets are then used to provide benefits to members when they retire or suffer a serious disability, or to a member’s family if the member dies.

The government taxes superannuation savings at a lower rate than normal savings if the superannuation fund complies with certain conditions. This gives superannuation funds the opportunity to provide increased retirement benefits.

WHAT IS A SELF MANAGED SUPERANNUATION FUND?

Australians can choose to contribute their personal superannuation contributions to an independently managed superannuation fund or to a self managed superannuation fund.

Self managed super funds (also known as DIY funds) perform the same role as other funds, by investing contributions and making them available to members on retirement. The difference is, generally, that the members of self managed super funds are also the trustees – they control the investment of their contributions and the payment of their benefits. With all members being trustees, they are in a position to ensure their interests as members are protected.

Generally, a superannuation fund is a self managed super fund if (with a few exceptions):

-

it has a trust deed that meets the requirements of the Superannuation Industry (Supervision) Act 1993 (SIS Act)

-

it has four or less members

-

each member of the fund is a trustee

-

no member of the fund is an employee of another member of the fund, unless they are related, and

-

no trustee of the fund receives any remuneration for their services as trustee.

For more information about self managed fund structures and rules, see our publication Self managed superannuation funds – role and responsibilities of trustees (NAT 11032).

Superannuation exists to

provide income to a person on retirement. To ensure superannuation

savings are protected, there are rules that must be followed. The Tax

Office’s role is to ensure that self managed super funds apply

these rules correctly, thereby protecting members’ superannuation.

These rules are outlined under requirements

and obligations.

GROWTH IN SELF MANAGED SUPERANNUATION FUNDS

There has been a steady increase in the number of self managed super funds since the Tax Office became the regulator in November 1999, from 190,000 to around 300,000 to the end of June 2004. The number of funds is currently growing at approximately 2,500 funds a month.

Participants

in the system:

TRUSTEES

All members of self managed super funds are trustees – they control the investment of their contributions and the payment of their benefits.

The role of a trustee should not be taken lightly. Trustees of self managed super funds are ultimately responsible for the running of their fund.

Trustees should familiarise themselves with the legislative requirements and administrative responsibilities of running a fund. These rules exist to ensure a fund’s assets are protected until they are needed at retirement. There are significant penalties imposed on trustees who fail to perform their duties.

APPROVED AUDITORS

Trustees of a self managed super fund are required, for each year or part year that the fund is in existence, to appoint an approved auditor to audit the operations of the fund.

An approved auditor may be a registered company auditor, the Auditor-General of the Commonwealth, a state or a territory, or a member of a professional organisation. (CPA Australia, The Institute of Chartered Accountants in Australia, National Institute of Accountants, Association of Taxation and Management Accountants, National Tax and Accountants Association Ltd.)

Auditors play a critical role in helping to ensure that trustees comply with the legislative requirements of the SIS Act and the Superannuation Industry (Supervision) Regulations 1994 (regulations).

TAX AGENTS

Trustees of a self managed super fund are required to lodge an income tax and regulatory return for the fund each year. They may get a tax agent to complete and lodge the return for them. Trustees must ensure that the tax agent has enough information to complete the return.

ACCOUNTANTS

Trustees of a self managed super fund must keep accounting records that record and explain the transactions so that a statement of financial position and an operating statement can be prepared. Trustees may get an accountant to help with these duties. Often a fund’s accountant will also be the fund’s tax agent.

FINANCIAL ADVISERS

Trustees of a self managed super fund may obtain help from a financial adviser. A financial adviser can:

-

help draft an investment strategy

-

provide advice on types of investments, and

-

help ensure that members’ investments and level of contributions meet their retirement needs.

Ultimately, the trustees of a

superannuation fund are responsible for the investments of their

fund.

THE ROLE OF THE TAX OFFICE AND THE AUSTRALIAN PRUDENTIAL REGULATION AUTHORITY

The Tax Office began regulating self managed super funds in 1999. Their role as the regulator of these funds is to ensure they comply with the SIS Act and regulations. Other complying funds are regulated by the Australian Prudential Regulation Authority (APRA) under the same Act.

APRA takes a prudential and risk based approach in an endeavour to prevent failure of the financial sector entities it regulates, including failure by superannuation funds to meet their existing and prospective liabilities.

Both the Tax Office and APRA are concerned that fund investments are in accordance with the trustees’ stated investment strategy and that the trustees can demonstrate that they have taken into account risk, return, diversification and cash flow requirements when preparing and implementing their investment strategy.

The Tax Office is also responsible for ensuring that trustees meet other obligations, including lodgment of an income tax return and surcharge member contributions statement, reporting reasonable benefit limits, applying the income tax provisions and, where applicable, lodging an activity statement.

The ATO makes contact with the

trustees of newly established self managed super funds shortly after

they set up their fund, alerting them to some of the more important

issues they need to be aware of. Statistically, we have established

that trustees who participate in this process have a better record of

compliance than those who do not.

MOVE TO ACTIVE COMPLIANCE

With the continued growth in the number of self managed super funds, the ATO is balancing compliance efforts and focusing more on active compliance.

They have a range of enforcement options available, depending on the nature of the breach and the circumstances. For more serious cases, they can make a fund non-complying. This has the significant tax consequence of the fund assets and income being taxed at 47%, rather than 15% for complying funds. They can also move to prosecute the trustees.

Another option they have is to

disqualify

trustees, which

prevents them from acting as a trustee of any superannuation fund. If

we believe a trustee is unable or unwilling to perform their role

adequately, we will disqualify them. We may take this action in

conjunction with other enforcement options.

HOW SELF MANAGED SUPERANNUATION FUNDS INVEST

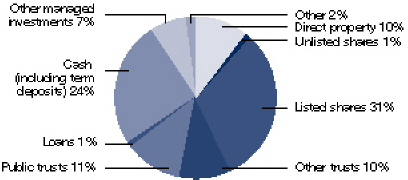

Self managed super funds have the largest proportion of their assets invested in listed shares, but only a small proportion invested directly in international shares. Currently these funds have a much greater proportion of their assets invested in cash than do other superannuation funds.

The following graph represents

asset allocations of self managed super funds, based on information

provided in regulatory returns lodged for the 2002 financial year.

HOW MANY MEMBERS CAN THERE BE?

The fund can have up to four members who do not need to be related. Therefore you can establish a fund with your partner, family, friends or a mixture. This means that all of your super balances are combined into one SMSF. When there is more than one member the individual member balances are tracked and member statements produced.

HOW MUCH IS REQUIRED TO START A SMSF?

A general rule of thumb is a minimum of $100,000 and growing rapidly, or ideally $200,000 is needed. This can be the total amount in the fund from all members.

WHAT ARE THE ADVANTAGES OF A SMSF?

-

Control - as superannuation is a crucial element in attaining financial independence, it is important that you have control of these funds. The flexibility of a SMSF allows this.

-

Full knowledge of investments - through a SMSF, you know what investments are made, and these are made to suit your personal circumstances.

-

Protection - the assets of the SMSF are protected from bankruptcy and other legal claims.

-

Estate planning - a SMSF provides great flexibility in the event of the death of one member, with the ability to pay an income stream to beneficiaries.

-

Taxation - if structured correctly, a SMSF could end up paying little or no tax.

CAN ONGOING CONTRIBUTIONS FROM MY EMPLOYER BE PLACED INTO MY SMSF?

Yes, as of the 1st July 2005 superannuation choice of fund means that you can instruct your employer to pay superannuation contributions to your SMSF.

WHAT IS A TRUSTEE AND WHO CAN BE ONE?

You have two choices with the trustees of your SMSF, individual or corporate. Individual trustees are the most common. Where the individual option is taken every member must also be trustee, so if you have two members these same two members will be trustees.

It is important to note that a SMSF cannot have a sole individual as a trustee, there must be more that one person as trustee if the individual option is chosen. A method around this for single people is to have a corporate as a trustee.

Corporate trustee is the other option available. This is where a company is the trustee of the super fund. It is also important to note that the member of the fund must be a director of the company if a corporate trustee option is chosen.

WHAT CAN THE FUND INVEST IN?

The investment options of the fund are extremely broad, the best way to detail what the fund can invest in is to take the opposite and detail what is not allowed. A super fund cannot borrow, therefore it cannot purchase a property and have a mortgage or have any other borrowings for investment purposes. A SMSF also cannot invest in in-house assets, so it cannot purchase your assets from you (eg house, investment property) and have these as investments. These are the main restrictions. So your fund can invest in direct shares, share trusts, property syndicates, hedge funds or any other traditional and boutique investment. As part of our service we provide you with access to investments on a discounted basis.

CAN THE FUND PROVIDE INSURANCE?

Absolutely, you can arrange life and total and permanent disablement cover with any company and have the SMSF own the policy. The SMSF pays the cost of the insurance and claims this as a tax deduction, making your insurance costs more tax effective. We assist you in finding the best insurance options and completing your applications.

WHAT ARE THE ONGOING COSTS?

These are charged by an accountant to complete the annual return for your fund. The fee for this service is typically, $800-$1000 for the annual return and audit.

OUR SELF MANAGED SUPER SERVICE

-

establishment of the Trust Deed and 2 hard copies of the deed

-

establishment of TFN & ABN

-

lodgement to become a regulated super fund

-

resolutions and minutes to establish the fund

-

notice to consent to act as trustee

-

binding death benefit nomination

-

establishment of investment strategy

-

rollover of existing super into your self managed fund

Ongoing requirements:

-

financial statements

-

comprehensive annual report

-

members statement

-

tax return

-

preparation of fund minutes

-

audit of fund

The ongoing fees are paid by the fund itself, therefore you do not have to personally meet this expense each year.

For a self managed fund to be effective, as a general rule of thumb, a minimum of $100,000 should be held in super and growing rapidly, or ideally $200,000 is needed. This can be the total amount in the fund from all members.