Economic analysis using discounted cash flow (DCF) will indicate whether or not the proposed conversion is economical. An advantage the existing building may have is that it is larger in size and site coverage than that allowable for a new building. Further, the building may have some prestige or historical character adding to the marketability of the proposed units and hence, the building value. To determine the best economic option for an old block of flats the valuer should analyze the following 4 options:

* OPTION 1: "Do nothing": This is always the first option and could be the most economical.

* OPTION 2: Renovate, upgrade and lease: That is, keep the building as a block of flats for investment purposes but renovate to modern requirements.

* OPTION 3: Renovate and upgrade and convert to strata title: Assume that the units will be sold to either investors or owner occupiers.

* OPTION 4: Demolish and rebuild the building as strata units. Except for option 1 the analysis is carried out using discounted cash flow.

To illustrate the 4 options each is applied to the following case study:

CASE STUDY - A BLOCK OF 10 FLATS

SITE AREA: 35.48m * 32.92m rectangular = about 1 166 m2

ZONING Residential density development zone in which strata titled units are allowed.

BUILDING The building consists of 10 flats in an "L" shape built about 1972. 5 flats are at ground level and there are identical 5 flats on the first floor. Each is of about 64m2. However, the ground floor flats have individual front and rear courtyards whereas the first floor flats have balconies.

THE SUBJECT BUILDING

Access to the first floor is by external wooden stairways. Building materials consist of cream bricks, cement tile roof, aluminium windows, concrete floors and overhanging balconies with steel balustrades. The building is in good order.

REQUIRED REFURBISHMENT

Benchtops in kitchens require replacing. Light fittings and window treatments are very basic and need replacing. Generally, both the kitchen and bathrooms require new and more modern prime cost items.

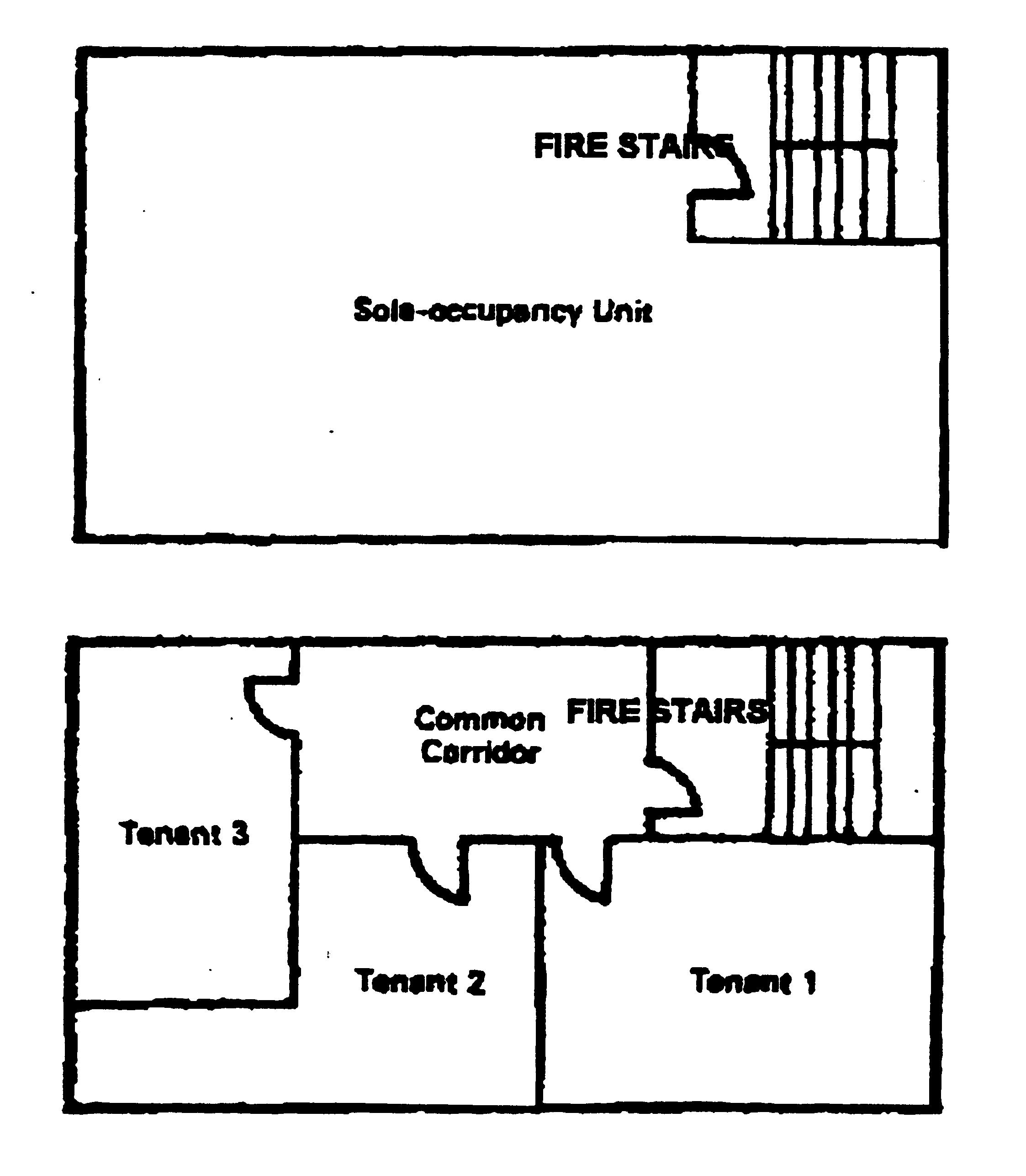

FIRE CODE

Under the relevant fire code, buildings containing 2 or more flats are Class II buildings. The subject building is not within a "fire zone". The type of construction required is determined by the Class (II) and the number of floors. In this case the property should have Class 3 construction. The required rating within a non fire zone is 1.5 hours for all structural members and 4 hours for the common or party walls. All integral parts of the building meet this requirement except for the wooden stairway which will have to be replaced by a suitable steel stairway. Further, a new external fire escape which meets required rating is necessary. One disadvantage of conversion is the cost of modern fire requirements. This not only includes necessary plant and equipment but often a redesign to allow new fire stairs and the subsequent loss of space:

New external fire escape: 5 000

Smoke detectors: 2 000 Other: 1 000

OPTION 1 - "DO NOTHING"

| EXPECTED INCOME $ 10 flats @ 100 per week =

|

52 000 |

| Less vacancies @ 10%pa average: |

(5 200) |

| Net annual realisation: | 46 800 |

| Less outgoings |

(20 000) |

| ------------- |

|

| Net annual return: |

26 800 |

| Capitalize @ 10% pa: | 268 000 |

COMMENT

The "do nothing" option is always the first option and could easily be the best option. In this case the building is in reasonable order and as the investment is returning 26 800 per annum net with little risk, the "do nothing" option which generates a market value of 268 000 could be the "highest and best" use. This will not be known until the other options are considered.

OPTION 2 - "RENOVATE & LET"

| EXPECTED COST OF REFURBISHING | |

| Internal surfaces painting |

8 500 |

| Carpet: | 15 500 |

| Benchtops: |

8 000 |

| Extras: |

5 000 |

| New PC items: |

20 000 |

| Repair and modernising bathrooms: |

25 000 |

| ----------- |

|

| TOTAL COST: | 82 000 |

| EXPECTED END MARKET VALUE AFTER REFURBISHMENT | |

| EXPECTED INCOME 10 flats @ 150 per week =

|

78 000 |

| Less vacancies @ 10%pa average: |

(7 800) |

| ------------ |

|

| Net realisation: |

70 200 |

| Less outgoings | (15 000) |

| ------------- |

|

| Net annual return: |

55 200 |

| Capitalize @ 8.5% pa: | 649 412 |

| say 649 000 |

COMMENT

After refurbishment the rent will increase and at the same time the newer and better finishes and PC items will reduce the outgoings. The building becomes "younger" and therefore, safer, therefore the capitalization rate is reduced to 8.5%pa.

DISCOUNTED CASH FLOW - OPTION 2

$ '000

| QUARTERS: | 0 |

1 |

2 | 3 | 4 |

| Legal/stamp duty: |

(16.1) | ||||

| Fees: (4) | (2) | ||||

| Refurbishment: | (4) |

(10) |

(25) |

(35) |

(8) |

| Holding charges: |

(1.4) |

(1.4) |

(1.4) |

(1.4) |

(1.4) |

| End market value: |

649 | ||||

| Legal/commission on sale: | (19) | ||||

| --------- |

--------- | --------- | --------- | --------- | |

| TOTALS: |

(25.5) |

(13.4) |

(26.4) | (36.4) | 620.2 |

| Discount rate @ 15% pa = 3.75% per quarter Discount factors: | 1 |

0.964 |

0.930 |

0.900 |

0.863 |

| DCF: |

(25.5) | (12.9) | (24.5) | (32.6) | 535.3* |

| NPV: |

440* |

*: differences in calculations caused by rounding

COMMENTS

If 15%pa is considered sufficient return for such a development then the developer is prepared to pay $440 000 for the existing building. This is substantially more than the market value "as is" and therefore, this is a "higher and better" use.

OPTION 3 - CONVERT AND SELL AS STRATA UNITS

CONVERSION TO STRATA $

| Development fund contribution: | 9 840 |

| Department's application fee: | 47 |

| Council's application fee: | 75 |

| LTO registration fee: |

538 |

| Legal fees: |

1 500 |

| Licensed surveyor: | 3 000 |

| --------- |

|

| TOTAL: | 15 000 |

| END MARKET VALUE AFTER STRATA CONVERSION & REFURBISHMENT - "IN LINE" METHOD | |

| 5 units @ 150 |

750 |

| 5 units @ 200 | 1 000 |

| -------- |

|

| Gross Realization: |

1 750 |

| After profit and risk @ 12% 1750 * 100/112 = | 1 563 |

| After commission, legal on sale @ 3% overall: 1563 * 100/103 = | 1 517 |

| say |

1 520 |

COMMENT

The "in line" method determines the value of a building with multiple units that is, a block of home units. The purchaser of a whole building will buy at a discount to provide him with a profit (12% profit and risk) after he/she has sold off all the strata units.

DISCOUNTED CASH FLOW - OPTION 3 $ '000

| QUARTERS: |

0 |

1 |

2 |

3 |

4 |

| Legal/stamp duty: | (16.1) | ||||

| Fees: |

(4) |

(2) | |||

| Strata conversion fees: |

(5) | (6) | (3) | (1) | |

| Refurbishment: |

(8) |

(18) |

(35) |

(30) |

(10) |

| Holding charges: |

(1.4) |

(1.4) |

(1.4) |

(1.4) |

(1.4) |

| End market value: | 1520 | ||||

| Commission /legal: |

(45.6) | ||||

| ----------- |

----------- | ----------- | ----------- | ----------- | |

| TOTALS: |

(29.5) | (26.4) |

(42.4) |

(34.4) |

1462 |

| Discount rate: 20% pa = 5 % per quarter Discount factors: | 1 |

0.952 | 0.907 | 0.864 | 0.823 |

| DCF: | (29.5) |

(25.1) |

(38.4) | (29.7) |

1202.8* |

| NPV: |

1080* |

* differences in calculation caused by rounding

COMMENTS

If the developer considers that 20%pa is sufficient return for the risk and expense of strata conversion then he/she is prepared to pay 1 080 000 for the existing building. This is much higher than the previous options and therefore, the "highest and best use" so far.

OPTION 4 - DEMOLISH, REBUILD AND SELL STRATA UNITS

Council will only allow 8 units.

Expected cost to build: 900 000

END MARKET VALUE AFTER REBUILDING -"IN LINE" METHOD $

| 4 units @ 220 = 880 and 4 units @ 250 = | 1 880 |

| After profit and risk @ 15% 1880 * 100/115 = | 1 634.8 |

| After commission, legal on sale @ 3% overall: 1634.8 * 100/103 = 1587.2 say | 1 590 |

DISCOUNTED CASH FLOW - OPTION 4

| $ '000 QUARTERS: |

0 |

1 |

2 |

3 |

4 |

5 |

6 |

| Legal/stamp duty: | (16.1) | ||||||

| Fees: |

(4) | (8) | |||||

| Strata conversion fees: |

(5) | (6) | (2) | ||||

| Demolition: | |

(5) |

(5) | ||||

| Rebuilding: | (50) | (100) | (150) | (250) | (200) | (100) | (50) |

| Holding charges: | (1.4) | (1.4) | (1.4) | (1.4) | (1.4) | (1.4) | (1.4) |

| End market value: | 1590 | ||||||

| Commission /legal: | (47.7) | ||||||

| |

----------- |

----------- | ----------- | ----------- | ----------- | ----------- | ----------- |

| TOTALS: |

(71.5) |

(119.4) | (162.4) |

(253.4) |

(201.4) |

(101.4) | 1491* |

| Discount rate: 20 % pa = 5% per quarter Discount factors: | 1 |

0.952 |

0.907 |

0.864 |

0.823 |

0.784 | .746 |

| DCF: |

(71.5) |

(113.7) |

(147.3) | (218.9) |

(165.7) |

(79.4) | 1112.6 |

| NPV: say 316 (000) | 316.3 |

* differences in calculation caused by rounding

COMMENTS

If the accepted profit and risk for the above development is 20% per annum then the value of the existing premises to a developer is 316 000. The profit and risk is higher because of the extra cost and risk involved in rebuilding compared for example, to that of refurbishing. The new council code will only allow 8 units

CONCLUSION

Discounting at the appropriate profit and risk rate for each option, it is apparent that option 3; "strata conversion of the existing building" is the best option showing the highest NPV. Therefore, this option is also the "highest and best use". STRATAING COMMERCIAL BUILDINGS The strata titling of old office/commercial buildings is often the "highest and best" use of the site. Advantages for smaller professional companies include not having to battle with the landlord at rent review time and a share of the benefit from any capital gains in land value.