The industry has a brief history when compared with the more traditional Australian livestock industries and no official Government records were kept until the mid 1960s so it is difficult to say when intensive poultry production began. However industry sources estimate that about 3 million broilers were produced in 1950-51, compared with about 290 million in 1989/90. The birth place of the industry was the outer Sydney metropolitan area.

The industry is an extremely capital intensive industry which requires a large degree of stability and predictability if there is to be any future investment. Present capital investment is in excess of $650 million. It directly employs between 12 000 and 15 000 people nationally, about 4 people/1000 bird throughput.

LOCATION

Chicken meat (broiler) production is located relatively close to areas of consumption. Besides the main areas around the capital cities there are substantial broiler farms around Tamworth and Newcastle (NSW.), Geelong (Vic) and Murray Bridge (SA). Location is determined mainly by the economics of transport in relation to markets, feed and processing facilities. Availability of reticulated or reliable water and electricity is also a factor. This concentration of the poultry industry in specialised areas in Australia causes the industry problems arising from attitudes of municipal authorities, planners, urban dwellers and conservationists.

These pressures in time may force the poultry industry further out into less suitable areas. Most commercial enterprises are intensive highly mechanised units which occupy relatively small areas compared to other forms of farming. Broilers are run at high density on litter floors in houses ranging from open naturally ventilated structures (near a large lake is ideal) in the warmer climates to fully enclosed controlled environment houses in colder climates.

OWNERSHIP

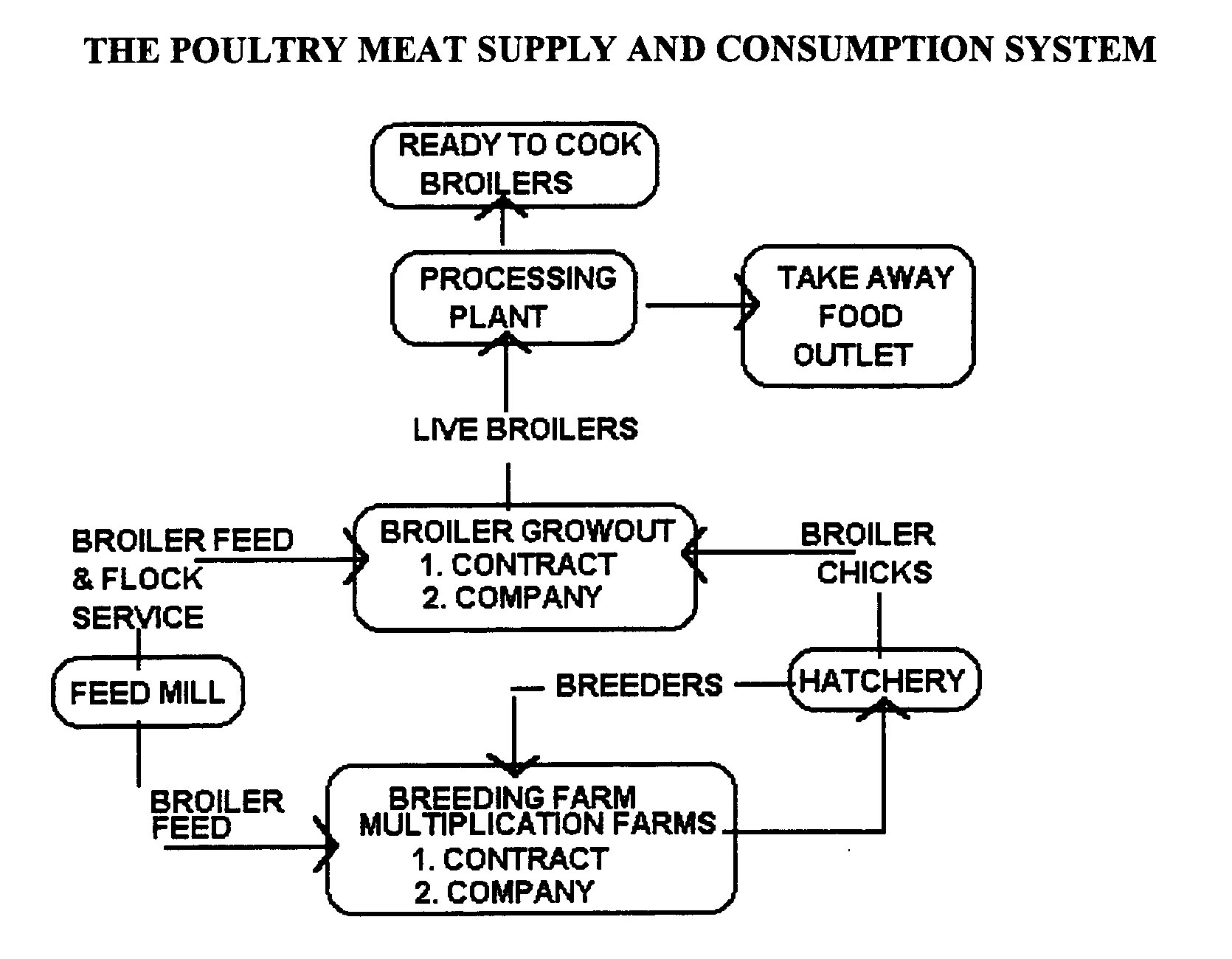

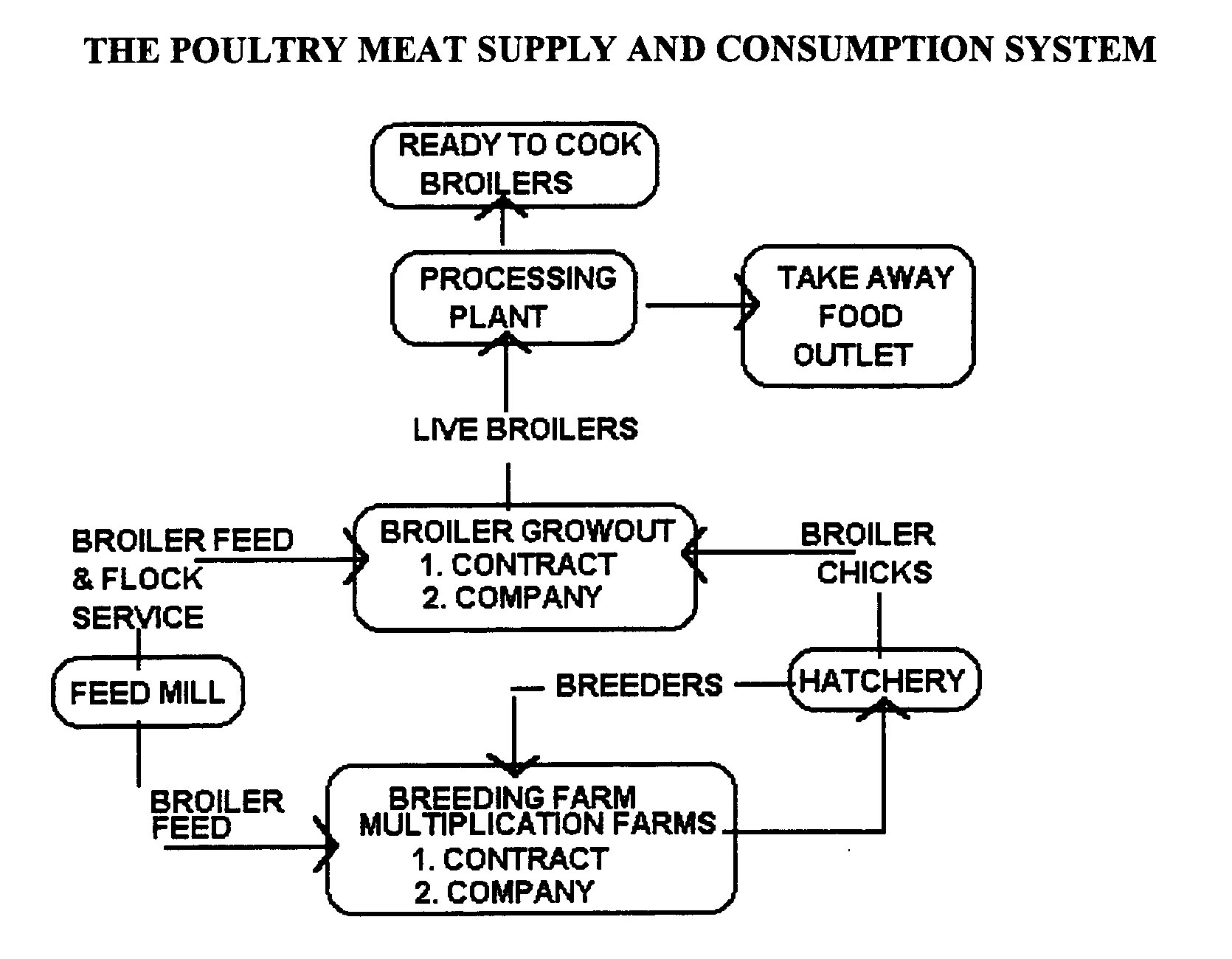

The chicken meat industry operate largely through vertical integration with company ownership of breeding farms, multiplication farms, hatcheries, feed mills, some broiler growing farms and processing plants – see diagram below. All operations from breeding through growing, processing and distribution are accurately timed and costed.

Two large integrated companies supply about 80% of the day old broiler chickens hatched and process almost three quarters of the broiler chickens marketed in Australia. The remaining 25% is shared among 5 medium-sized companies, and a myriad of small processors and hatchery men.

About

1 000 growers produce about 75% of total production under contract to

processing companies. The balance is produced by a small number of

large company farms. A typical family farm would house 60 000 broiler

chickens and produce 200000-300 000 birds per annum.

PRODUCTION

Production of chicken meat was estimated at 432 000 tonnes from slaughterings of 309 million birds, at an average dress weight of 1.42 kilos each. Chicken production has increased by 25% over the last decade in response to continued growth in consumer demand. Domestic consumption has risen by the same amount and currently stands at 23.1 kg/person/pa. Total poultry consumption is now about 25.1 kg per person/pa.

Turkey is the next most popular poultry meat with Australian consumers.

FEED USAGE

The industry uses about 500 000 tonnes of wheat as a major component of prepared stock feed per annum and is a relatively stable buyer all year and from year to year. It uses more than three quarters of all the meat meal produced in Australia and is a larger consumer of electric power; petroleum products and water.

GROSS VALUE AND GROWTH

The gross value of retail sales of the chicken meat industry in 1989/90 was estimated at $1.2 billion In terms of farmgate value, poultry meat ranks as the 6th most important rural industry in Australia, and was worth $790m in 1989/90 and $845 million in 1990/91. This represents an increase in gross value of production of 70% in 5 years.

CHICKEN MEAT CONSUMPTION

The rapid growth of the chicken meat industry over the past 20 years has resulted in a much greater emphasis being placed on poultry relative to other food items in the Australian diet, particularly red meat. There has been continual changing emphasis for convenience foods, such as take-away chicken, Chinese meals and TV dinners. Chicken meat has played an important role in these areas.

The share of disposable income spent on food has been relatively constant at about 16%. This clearly indicates that price and choice have been the key determinants of consumer spending. While the percentage of total food consumed has not varied greatly between categories, the variances in consumption of meat types has been dramatic.

Meat is a very volatile commodity, being subject to the trends in export markets and local climatic conditions. These factors are then further affected by consumer preference and choice.

The average Australian per capita consumption of chicken meat today is around 23.1 kg, an increase of 25% since 1981. This is forecast to continue to rise to around 28.6 kg per capita by 1992. Chicken is now firmly established as the second most popular meat choice of consumers, well ahead of sheepmeat (23 kg) and pigmeat ( 17 kg), and steadily overhauling beef on 38 kg.

THE

PROCESSING INDUSTRY

Poultry processing plants, together with all the other production areas in an integrated operation, have developed in proximity to markets and a ready source of labour. Almost all integrated operations are established in or within a 50 km radius of capital cities. The obvious advantages are in distribution costs, labour availability and services.

Significant disadvantages are emerging as suburbia encroaches, for example, limitations on expansion, effluent treatment and cost of disposal, livestock transportation through the cities and noise pollution.

The integrated nature of the industry is the principal factor impeding a shift in location of poultry processing plants as the establishment cost of replacement facilities is exorbitantly high.

The replacement cost of a typical 8 000 bird/hr plant is around $9m while an integrated operation of 300 000 birds/week embracing feed mill, fertile egg production, hatcheries, growout and processing requires around $50 m in fixed and operating capital.

The trend is to improve productivity in all areas to meet increased demand rather than to relocate. More emphasis in processing plants on reduction of water usage, effluent treatment and recovery, and shift work can increase the terminal capacity of most plants in Australia today - see diagram above.

It is likely that the relocation of poultry processing plants to decentralised areas will occur when expansion demands require such increases in all the production areas that a totally new integrated complex may be undertaken. The advantages of such factor feed costs, environmental aspects and labour stability outweighs the advantages of close proximity to the market.

Poultry has improved its price relatively in comparison with other meats progressively and at times spectacularly during the life of the industry. Much of this improvement has been attributable to the progressive and continuous automation of poultry plants.

FARM SIZE AND LOCATION

Alongside the siting and location of poultry plants is the siting and location of chicken growing farms. Processing companies, be they totally integrated or in processors, prefer their contract growers to he located close to the processing plant, preferably within about a 50 km radius. Important factors affecting location are:

Proximity to a feed mill. Most stock feed manufacturers would prefer farms to be within about 50 km of the mill.

Guaranteed water supply

Guaranteed supply of electric power. A reliable supply of 3 phase power.

Availability of heavy transport, realising the need for access for both fully laden feed trucks and live poultry haulage vehicles. Good access is required as large trucks need to gain entry at critical times.

Availability of a limited supply of labour depending on farm size

Availability of other services such as tradesmen, servicemen and veterinarians.

Close to the hatchery which is owned by one of the large companies

Close to the processing plant

Close to a body of water to help cool the farm.

EXAMPLE

Monarto in South of Adelaide is ideal for the location of such intensive land uses because:

It is highly accessible due to its proximity to the South Eastern Freeway. This location affords efficient delivery and pick up of birds and rapid transport to the processing plant.

A constantly controlled environment is essential for optimal bird production. As a result the electricity supply is required to be a 3 phase system which is extremely reliable. This requirement is satisfied in relation to the subject property due to it being connected to an ETSA grid which services the nearby prison. Due to this facility's nature, power supply is never interrupted a luxury which is therefore shared by the chicken farm.

It has a potable water supply is excellent due to the property being located on Adelaide's main pipeline.

Receives a cooling easterly breeze in the afternoon which helps to keep the cooling power costs at a low level.

MARKETING AND DISTRIBUTION

Poultry meat is marketed throughout Australia by the large integrated companies under various brand names through numerous outlets. Brands range from nationally recognised names to State recognised names and house brands. Numerous smaller processors also market chicken either under their own particular brand or in some cases without any brand identification whatsoever.

Limited media advertising support is given to poultry by processors. The only advertising poultry receives is through the supermarket industry (point of sale price being the main feature) and through the major fast-food take-away chains.

The poultry industry as a whole does not promote its product through the media, as it has historically been shown that consumption is related to price and that the percentage consumed varies only in relation to other meats as discussed earlier. Individual processors are however endeavouring to increase poultry consumption with the introduction of more varied ways of presenting poultry to the consumer, for example, pieces packs and further processed poultry products. Nevertheless individual companies are now using more television advertising than ever before.

| Poultry numbers 1987 to 1989 ('000) Australia 1989 | |||||||||||

|

1987

|

1988 | 1989 | NSW | VIC | QLD | SA | WA | Tas | NT | ACT | |

| Hens

and pulletsfor

egg production |

13506 | 13463 | 13193 | 4505 | 3143 | 2748 | 1043 | 1116 | 297 | 122 | 219 |

| Meat

strain chickens (broilers) |

39187 | 47988 | 39709 | 17373 | 6659 | 7683 | 3764 | 3667 | 464 | 99 | - |

| Total: | 55579 | 64201 | 56149 | 24699 | 9802 | 10431 | 4807 | 5210 | 760 | 221 | 219 |

| Ducks | 350 | 663 | 263 | 151 | 106 | 1 | 1 | 2 | 1 | - | - |

| Turkeys

|

1249 | 1585 | 1125 | 965 | 114 | 1 | 15 | 29 | 1 | - | - |

| Other

poultry |

430 | 365 | 420 | 156 | 108 | 34 | 17 | 34 | 71 | - | - |

| Total

all poultry |

57608 | 66813 | 57957 | 25972 | 10130 | 10467 | 4840 | 5275 | 833 | 221 | 219 |

| AUSTRALIAN SUPPLY AND USE OF POULTRY MEAT | |||||||||||

|

Item

Unit |

1982 | 1983 | 1984 | 1985 | 1986 | 1987 | 1988 | 1989 | 1990 | ||

| Poultry

meat Slaughterings mill. |

227.7 | 231.2 | 240.0 | 268.0 | 276.5 | 290.9 | 290.2 | 296.6 | 308.7 | ||

| Average

dressed weight

kg |

1.3 | 1.3 | 1.3 | 1.4 | 1.3 | 1.4 | 1.4 | 1.4 | 1.4 | ||

| Production

kt |

298 | 302 | 315 | 365 | 370 | 394 | 406 | 415 | 432 | ||

| Exports

kt |

2.7 | 1.3 | 1.1 | 1.4 | 2.5 | 2.5 | 1.4 | 1.5 | 2.0 | ||

| Total

consumption kt |

295 | 300 | 314 | 363 | 368 | 391 | 404 | 414 | 430 | ||

| Consumption/person

kg |

19.5 | 19.5 | 20.2 | 23.0 | 22.8 | 24.0 | 24.5 | 24.6 | 25.1 | ||

The

industry is dominated by just 3 companies which together account for

about 98% of the total market. For a successful broiler enterprise it

is necessary to have a production contract with one of them.

The new breeds of chicken pioneered by the large producers have produced birds with low fat, low cholesterol and with a long shelf life by reducing the risk of salmonella poisoning.

The industry is currently enjoying popularity in the market place as consumption of this form of white meat steadily increases. The birds have a very high feed conversion ratio of 1.8 kg of feed producing 1 kg of white meat. This is the highest conversion ratio of any of the white meats.

The Poultry Meat Industry is governed by state legislation the relevant acts are generally concerned with licensing, health and the control of production. For example, in South Australia the Poultry Meat Industry Committee will only grant approval for the establishment of a new poultry enterprise "if it is satisfied there is a demand for the supply of chickens for processing that can not reasonably be met by the operators of approved farms using existing facilities".

CASE

STUDY A

TYPICAL BROILER ENTERPRISE

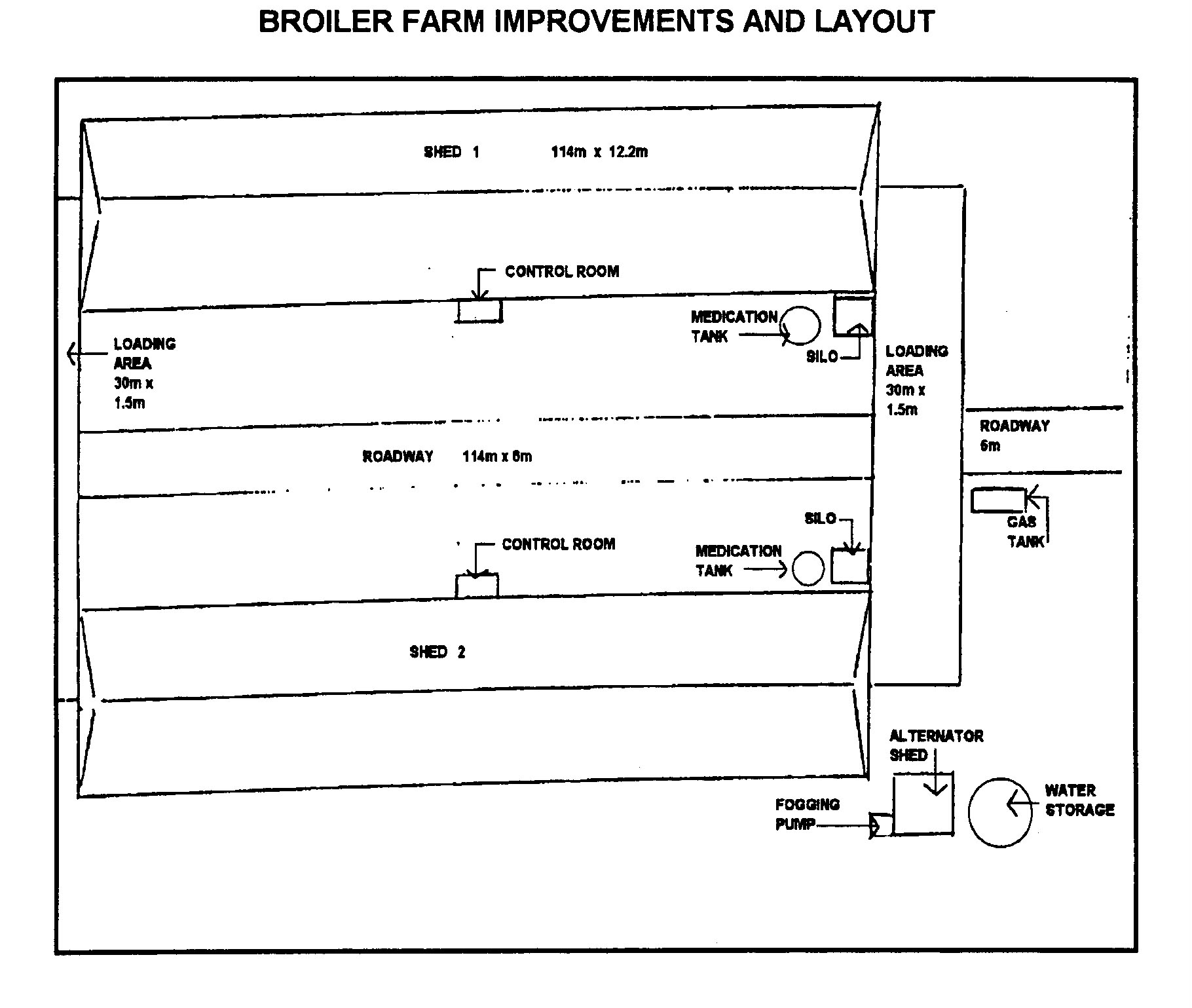

Under the terms of the contracts growers provide shedding and equipment of a prescribed standard and labour to grow the chickens from day-old to market weight. A typical property has about 1 672 m2 of shed and occupies about 2.5 ha. An investor in a broiler enterprise has the choice of either buying an existing poultry farm or entering into a new contractual agreement with one of the big producers.

IMPROVEMENTS

The improvements directly related to the chicken enterprise are as follows:

An 1 672 m2 shed with a controlled growing environment afforded by way of a 'cross flow' system. This system regulates the shed climate by dragging air across the shed with an inlet and fans situated on only one side. This environment control system is low cost and economical to run. Chickens are supplied by the company and a typical operation processes 32 000 chickens at any one time. It averages 5.6 batches pa with a 68 day cycle and 14-20 days gap between batches. See diagrams below.

Three feed silos each integrated with augers. The feeding system consists of automatically operated self feeders.

A header tank for the drinking and cooling systems. Vaccines and vitamins can be added-to this supply in line with the requirements of the birds. A staged computer system which controls the 'cross flow' ventilation.

POLLUTION

CONTROL AND ENVIRONMENTAL FACTORS

Intensive farm systems such as those described here have caused a great deal of environmental concern because of problems caused by the disposal of effluent. This has led to statutory controls on intensive land uses and in some cases, the outright prohibition of an intensive land use. These problems are particularly pertinent in water catchment areas.

The valuer must ascertain whether there are "orders" over an intensive land use from the relevant authority and if so, what construction and controls are required to satisfy the orders. Draconian controls and orders may make the land use uneconomic and no longer the "highest and best use" of the land. Such controls are a very good example where the outside legal environment directly affects and determines the land use system.